Buy Senco Gold Pvt Ltd For Target Rs.800 - Emkay Global Financial Services

Senco’s Q2 EBITDA was 3%/14% higher than estimated, on better topline performance. Revenue grew 26% (Emkay: 20%), led by improved franchisee growth (15% in Q2 vs. flat last year), studded mix (+100bps) and emerging traction in the Men’s segment. SSG has been encouraging, at 19% in H1. Q3TD trend is heartening, given healthy footfalls in the festive season and expectancy of a big wedding season ahead. Senco added 8/1 net COCO/FOFO stores in H1, with 8 more in Oct-23; it is on track for 25 adds in FY24. Number of FOFO stores is also likely to go up, with Bihar emerging as an attractive prospect, along with Bengal/Orissa. Senco’s WC increased by Rs2.1bn in H1, towards new-store openings and higher WC in existing stores— to support strong growth. EBITDA margin was flat, on diamond-led inventory gains in the base and one-off IPO expenses. Despite the beat, we do not raise estimates, due to low Q2 PAT salience. Senco offers 20% EPS CAGR potential, with differentiated positioning and network expansion. We maintain BUY (TP: Rs800/sh; 25x Dec-25E EPS).

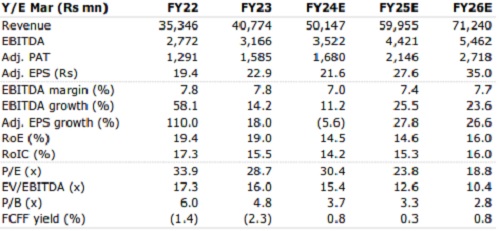

Senco Gold: Financial Snapshot (Consolidated)

Decent Q2 performance; encouraging festive/wedding commentary

Revenue grew 26% in Q2, led by a 13-14% gold-price increase with the balance contribution from volume growth. SSG was best-in-class at 19% in H1, with festive/ wedding expectations for Q3 still strong, on the back of increase in Gold price and early footfall trends at stores. Studded revenue growth was even higher, at over 50%, driving ~100bps increase in studded mix to 12%. Among formats, COCO/FOFO registered a studded mix of 14%/8% in Q2, with focus on further improving the blended mix to 15%. We believe Senco’s strategic focus on the northern markets should drive this increase, as the region leads with 19% studded mix vs. 12-14% for other regions. Senco opened 9 stores in H1, with 1/8 stores in the FOFO/COCO format. With 8 more additions in Oct23, Senco is on track to add 25 stores in FY24. FOFO store additions should also increase in H2, with Bihar emerging as an attractive opportunity, along with West Bengal and Orissa. Operating leverage and better studded mix helped to offset the impact of hedging loss, one-off in the base, and IPO expenses in Q2FY24, leading to flat EBITDA margin at 3.4%. Margin is expected to improve in H2, on strong operating leverage and better mix.

Earnings-call KTAs: 1) The West/South witnessed higher growth in Q2, but focus currently remains on expanding in the North/East. Senco expects 100 store additions over the next 4-5 years. 2) Senco is witnessing a noticeable trend with pick-up observed in the Men’s segment, as sportsmen/celebrities are adorning men’s jewelry. 3) Regionwise, the West/South/East/North registered growth of 43%/31%/27%/26%. 4) Blended per store revenue stood at Rs330mn, with COCO/FOFO stores logging Rs370/260mn. 5) The IPO proceeds have been deployed in WC of 8 new stores and increase in WC of existing stores would improve studded mix. 6) Despite the 28% growth in H1, Senco restricted full-year revenue growth outlook to ~20%, albeit acknowledged that its outlook is conservative. 7) The hedge ratio for H1 stood steady at 84%, restricting inventory gains from increase in gold prices. 8) Consumers are not aware of the steep fall in prices of high-carat diamonds; Senco is educating customers on this change and providing attractive marketing schemes to its customers. 9) ATV stood at Rs66k compared with ~Rs54k last year. 10) Repeat customer vs new buyer ratio stood at 64:36.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf &

SEBI Registration number is INH000000354

-98.jpg)

.jpg)