Buy Greenply Industries Ltd For Target Rs. 423 by Choice Broking Ltd

Firing on Multiple Cylinders

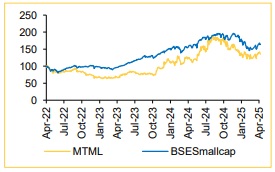

We maintain BUY rating on Greenply Industries Ltd (Bloomberg Code: MTLM) with a revised target price of INR 423/Share as we factor in 1) Volume growth (9.7% over FY25-28E which exceeds industry growth of ~7%) driven by market share gains from unorganized players in the plywood segment, 2) addition of 25% capacity and higher capacity utilization (increases by 25% over FY25-28E) in MDF segment, which would drive volume growth, 3) Revenue contribution from the new JV, BV Samet from FY26 onwards and incorporate a PEG ratio based valuation framework that allows us a rational basis to assign a valuation multiple that better captures earnings growth.

We forecast MTLM EPS to grow at a CAGR of 42% over FY25-28E, basis our volume growth assumptions of 9%/10%/10%, and realization growth of 2% for Plywood segment, 30%/18%/15% volume growth and realization growth of 5.0%/5.0%/ 2.0% in FY26E/27E/28E for MDF segment and INR 1,500Mn of revenue from New JV business.

We arrive at a 1-year forward TP of INR 423/share for MTLM. We now value MTLM on our PEG ratio based framework – we assign a PEG ratio of 1x on FY25-28E core EPS growth of 42%, which we believe is a conservative multiple. This valuation framework gives us the flexibility to assign a commensurate valuation multiple based on quantifiable earnings growth.

We do a sanity check of our PEG ratio based TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 423, FY27E implied EVEBITDA/PB/PE multiples are 14.2x/4.6x/25.8x all of which are reasonable in our view. Slowdown in Real estate and home improvement activities, delay of BIS & QCA norms on imports and higher timber cost are risks to our BUY rating.

Q4FY25: Margins were ahead of estimates despite weak volumes; Core PAT adjusted for one offs/non core reasons is healthy

Plywood: Q4FY25 volume came in at 19.7Mn Sqm (up by 4.8%/8.2% on YoY/QoQ), realization was up by 3.7%/1.5% on YoY/QoQ to INR 254, which led to revenue growth of 8.7/6.6% YoY/QoQ to INR 5,000Mn. Plywood margins improved 50/80bps YoY/QoQ to 9.2% vs CEBPS estimates of 8.2%.

MDF: Q4FY25 volume came in at 42,688 down by 6.7% YoY but up 1% QoQ, realization up by 10.9% YoY to INR 31,765 CBM and which led to revenue growth of 3.4/.7% YoY/QoQ to INR 1,356Mn. MDF margins improved 120/460bps YoY/QoQ to 15% vs CEBPS estimates of 13%.

MTLM reported Q4FY25 consolidated Revenue and EBITDA of INR 6,488Mn (+5.6% QoQ, 8.2% YoY) and INR 681Mn (+26.0% QoQ, +18.1% YoY) vs CEBPL estimates of INR 6,790Mn and INR 630Mn, respectively. Core PBT for Q4FY25 came in at INR 245Mn, (vs CEBPL est. INR 291Mn), down 48.9/31.8% YoY/QoQ. EPS for the quarter came in at INR 1.3.

Outlook:

Targeting double digit growth in Plywood segment: Management is now targeting double-digit volume growth for FY26, having achieved 5.5% volume growth to 75.8Mn Sqm in FY25, with margin guidance of 10% for FY26 vs 8.5% in FY25. Multiple price hikes in Q3 and Q4 led to improvement in realization by 2% YoY to INR 252 per Msm.

Targeting 88% Capacity Utilization in MDF segment for FY26: Management is targeting 88% capacity utilization and a margin of 16% for FY26, driven by increased sales of value-added products. To support these targets, management plans to expand capacity by 25% in FY26, increasing daily capacity from 800 CBM to 1,000 CBM.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131