Buy R R Kabel Ltd For Target Rs. 1,720 By JM Financial Services

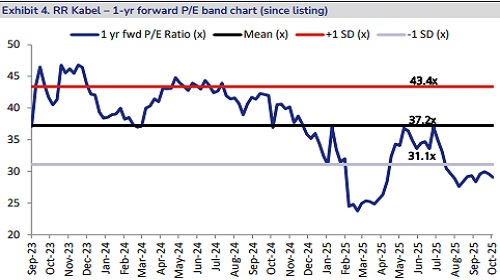

RR Kabel’s 2Q performance was ahead of expectations on all fronts, driven by volume growth (+16% in 2Q, +12% in 1H) and value growth in the cables & wires (C&W) segment, resulting operating leverage benefits, and an improved revenue mix. The FMEG vertical, on the other hand, witnessed a muted quarter owing to industry-wide headwinds, especially w.r.t. fans, while lighting was a relative outperformer. The management reiterated its guidance, and indicated that (1) 2H volume should be better than 1H, putting the company on track to achieve 18% volume growth in FY26E, as guided, and (2) it is confident of an improvement of 100bps in FY26E C&W EBIT margin and the aspiration is to get to 10.5-11% by FY28E, driven by a changing product mix, as benefits of the company’s INR 12bn capex (80% of which is targeted towards cables) come in. We revise our FY26-28E EPS estimates by 2-4%, and maintain BUY with a target price of INR 1,720 (1,650 earlier), valuing the stock at 35x Sep’27E EPS.

* 2Q performance a beat on all fronts: RR Kabel’s 2Q revenue rose 20% YoY to INR 21.6bn, ahead of our estimate by 3%. This was driven by a 22% YoY growth in the cables & wires (C&W) business, while revenue from the FMEG vertical declined 3% YoY on the back of seasonal headwinds. EBITDA at INR 1.8bn, +2x YoY was 17% ahead of estimate, while margin at 8.1%, expanded 340bps YoY and was 100bps higher than estimate. The strong EBITDA performance was a result of higher-than-expected gross margin at 18.9% (vs. estimate of 18.5%) and lower-than-expected operating expenses. 2Q PAT at INR 1.2bn, +2.3x YoY, too, was higher than estimate of INR 939mn.

* C&W revenue growth a mix of volume and value growth: RR Kabel’s C&W segment reported YoY growth of 22%. Growth in the C&W business was the result of 16% volume growth and higher input costs. Further, within this vertical, domestic revenue rose 23% YoY and constituted 73% of segment revenue (vs. 71% in 1QFY26 and 62% in 2QFY25), while exports grew 20% YoY and constituted 27% of segment revenue. Europe and Middle East remained the company’s largest export markets, cumulatively constituting 75-80% of total export revenue, while exposure to the US was 6-8% of total export revenue, with an uptick expected as clarity over tariffs emerges. EBIT margin in this segment stood at 9.2%, expanding 410bps YoY, gaining from operating leverage benefits.

* FMEG business weak as expected; management hopeful of EBIT break even by FY26E end: RR Kabel’s FMEG segment reported a YoY decline of 3% to INR 1.9bn. This was owing to seasonal headwinds and high channel inventory, especially in fans, which is RR Kabel’s key FMEG product, while growth in the lighting vertical outperformed other categories. FMEG constituted 9% of total company revenue vs. 11% sequentially and YoY. EBIT margin in the FMEG segment stood at-6.1%, vs. -5.9% YoY. Management commentary highlighted that FMEG should break-even on an EBIT level by end-FY26E; however, on a full year basis, EBIT losses will continue, given a weaker 1H.

* FY26E guidance unchanged: The management guided that 2H volume would be better than 1H (1H volume growth at 12%) and put the company on track to achieve the guided 18% volume growth in FY26E. Further, it indicated that the target is for a 100bps margin improvement in FY26E on a consolidated basis. Of this, the current EBIT margin profile (1H C&W EBIT margin at 8.3%) in the C&W vertical is around sustainable levels, and the aspiration is to get to 10.5-11% by FY28E. This will be driven predominantly by a changing product mix.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361