Buy PNB Housing Ltd For Target Rs. 1,230 by Motilal Oswal Financial Services Ltd

Strong quarter on the back of robust execution

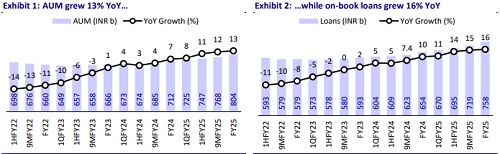

Retail loan growth of ~18% YoY; NIM expanded ~5bp QoQ

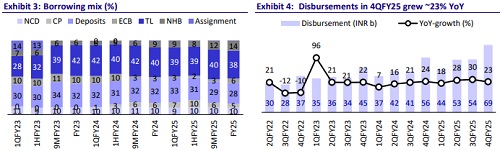

* PNB Housing (PNBHF) delivered an all-round healthy performance, marked by: 1) a healthy retail loan growth of ~18% YoY, 2) an expansion of 5bp QoQ in NIMs, 3) a sustained improvement in asset quality, and 4) recoveries from its retail written-off pool, which resulted in provision write-backs for the entire year. PNBHF’s 4QFY25 PAT grew 25% YoY/14% QoQ to ~INR5.5b (~9% beat). FY25 PAT grew 28% YoY to INR19.4b.

* NII in 4QFY25 rose ~17% YoY to ~INR7.3b (in line). Opex rose ~19% YoY to ~INR2.12b (in line). PPOP grew ~14% YoY to INR6.5b (6% beat). Credit costs, net of recoveries, resulted in a write-back of ~INR648m, which led to net credit costs of -35bp (PQ: -20bp and PY: 4bp).

* PNBHF expects FY26 to be a stronger year for the mortgage industry, anticipating a pick-up in demand as interest rates decline. The company guided for Retail loan growth of 18% YoY in FY26, with the affordable housing loan book projected to reach ~INR95b by Mar’26 and ~INR150b by Mar’27. Additionally, it guided for corporate disbursements of INR15-20b in FY26.

* PNBHF secured its last credit rating upgrade to AA+ in 4QFY24 and 1QFY25. Backed by its sustained strong performance, the company expects another credit rating upgrade by end-FY26, which should further help reduce its cost of borrowings.

* GNPA/NNPA stood at ~1.08%/0.69% (% of Loan Assets) and improved ~11bp each QoQ. Retail GNPA improved ~12bp QoQ to 1.1%, while Corporate GNPA was NIL (similar to last quarter).

* We continue to believe in our thesis of a transformation at PNBHF and in the management’s ability to drive RoA improvement, supported by: 1) healthy retail loan CAGR of ~18%; 2) NIM expansion from FY27 onwards; and 3) benign credit costs on the back of sustained recoveries from the written-off pool.

* We expect PNBHF to deliver a CAGR of 19% each in loans/PAT over FY25-27E and ~2.5%/14% RoA/RoE in FY27. Reiterate BUY with a TP of INR1,230 (based on 1.5x Mar’27E BVPS).

Highlights from the management commentary

* PNBHF plans to expand its affordable housing branch network to 300 branches by FY27, up from 200 branches as of FY25. Management guided that emerging and affordable housing in the Loan mix will reach ~32-34% by FY26 and ~40% by FY27.

* In the affordable housing segment, the industry-level bounce rate stands at ~15-16%, whereas for PNBHF, it is significantly lower at ~10.5-11%.

* Management guided for NIM to remain stable at 3.6-3.65%, driven by a change in the product mix, decline in the CoB, and better yields from growth in the Corporate segment.

Valuation and view

* PNBHF delivered an all-round healthy performance in 4Q and FY25, driven by robust execution leading to healthy loan growth, asset quality improvement, margin expansion, and strong profitability. We believe the company is wellpositioned to maintain this earnings momentum and deliver on its articulated guidance in the coming years.

* The stock trades at 1.2x FY27E P/BV, with a favorable risk-reward profile that could support a re-rating in the valuation multiple as investor confidence grows in the company’s consistent execution in retail (across prime, emerging, and affordable segments). Reiterate BUY with a TP of INR1,230 (based on 1.5x Mar’27E BVPS). Key risks: a) the inability to drive NIM expansion amid aggressive competition in mortgages and b) subsequent seasoning in the affordable/emerging loan book leading to asset quality deterioration and elevated credit costs.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412