Buy Phoenix Mills Ltd for the Target Rs. 2,003 by Motilal Oswal Financial Services Ltd

Strong consumption growth and leasing; buoyant residential sales

Consumption grows 12% in 1HFY26

* PHNX reported revenue of INR11.2b, +22% YoY/+17% QoQ (in line with estimates), while EBITDA came in at INR6.7b, up 29% YoY/18% QoQ (6% above estimate). Margin stood at 59.8%, up 340bp YoY/58bp QoQ (210bp above our estimate). In 1HFY26, revenue stood at INR20.7b, +14% YoY, while EBITDA came in at INR12.3b, up 17% YoY. Margin stood at 59.5%, up 196bp YoY.

* Adj. PAT stood at INR3b, +39% YoY/+26% QoQ (20% below estimate due to higher values of taxes and associate profits). PAT margin stood at 27.3%. In 1HFY26, adj. PAT stood at INR5.4b, up 21% YoY, with margins of 26.3%.

* In 2QFY26, group net debt stood at INR22.03b from INR26.6b in 1QFY26.

Retail witnesses strong consumption

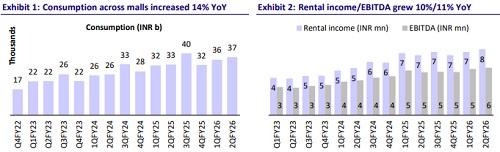

* In 2QFY26, consumption increased 13% YoY to INR37b, while it grew 12% YoY to INR73b in 1HFY26. This was led by Phoenix Palladium (Mumbai), Phoenix Citadel (Indore), Palladium Ahmedabad, Phoenix Mall of the Millennium (Pune) and Phoenix Mall of Asia (Bengaluru).

* Consumption in Phoenix MarketCity Bangalore and Pune was flat YoY due to the ongoing strategic repositioning to enhance customer experience and long-term growth potential.

* In 2QFY26, on an overall basis, fashion/jewelry/electronics/multiplex outperformed with 17%/12%/23%/23% YoY growth, while gourmet declined 16% YoY. F&B grew 8% YoY.

* The company reported rental income of INR5.3b, up 10% YoY. In 1HFY26, rental income stood at INR10.4b, up 7% YoY.

* Retail EBITDA stood at INR5.5b in 2QFY26, up 10% YoY. In 1HFY26, it stood at INR10.9b, up 7% YoY.

Office occupancy rises, while Hospitality occupancy remains flat

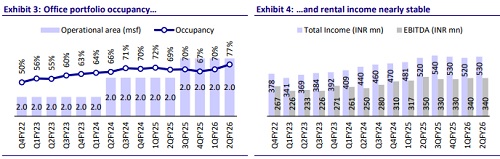

* Commercial performance: Gross leasing of ~0.72msf completed as of 1HFY26 for assets in Mumbai, Pune, Bangalore and Chennai.

* In 2QFY26, occupancy for operational assets in Mumbai and Pune was up 9% vs. 4QFY25 and up 7% QoQ to 76%.

* Completion certificate for One National Park (Chennai) was achieved in Aug’25.

* Phoenix Asia Towers in Bengaluru achieved the USGBC LEED PlatinumTM Certification in Jul’25.

* Income from commercial offices in 2QFY26 stood at INR540m, flat YoY, and EBITDA came in at INR330m, down 2% YoY. Margins stood at 61%. In 1HFY26, income stood at INR1.06b, up 2% YoY, and EBITDA came in at INR670m, flat YoY. EBITDA margin stood at 63%.

* Hospitality: St. Regis - 2Q occupancy at 85% vs. 85% in 1QFY25. In 1HFY26, it was at 84%, down 1% vs. YoY.

* For 2QFY26, ARR at INR17,711 was up 2% YoY and RevPAR at INR15,025 was up 2% YoY. In 1HFY26, ARR grew 7% YoY to INR18,106 and RevPAR rose 7% YoY to INR15,251.

* In 2Q, total income for St. Regis inched up 1% YoY to INR1.1b. EBITDA grew 13% YoY to INR530m, with margins of 47%. In 1HFY26, total income stood at INR2.3b, up 5% YoY. EBITDA stood at INR1.03b, up 16% YoY with margins of 46%.

* Marriott, Agra: 2Q occupancy at 60% vs. 67% YoY. In 1H, it was flat YoY at 65%.

* For the quarter, ARR at INR4,396 was down 4% YoY and RevPAR was down 14% YoY at INR2,621. In 1HFY26, ARR was flat YoY at INR4,384 and RevPAR was up 1% YoY at INR2,862.

* Total income in 2QFY26 for Marriott was INR88m, down 11% YoY. EBITDA stood at INR4m, down 50% YoY, with margins of 5%. In 1HFY26, total income stood at INR198m, up 6% YoY. EBITDA stood at INR20m, down 8% YoY, with margins of 10%.

Valuation and view

* While new malls continue to ramp up well, PHNX is implementing measures to accelerate consumption at mature malls. These initiatives, along with a further increase in trading occupancy, will help PHNX sustain healthy traction in consumption.

* The company’s acquisition of the remaining 49% stake in Island Star Mall Developers (ISMDPL) strengthens its high-quality retail asset portfolio, unlocking long-term value. The transaction is expected to be earnings-accretive from year one with significant upside as rental income stabilizes and the 2.71msf incremental FSI potential is developed over the medium term.

* We retain our BUY rating with a revised TP of INR2,003/share (earlier INR2,044/share), implying upside potential of 19%.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412