Buy Nippon Life India AMC Ltd for the Target Rs. 1,060 by Motilal Oswal Financial Services Ltd

Revenue in line, beat on EBITDA

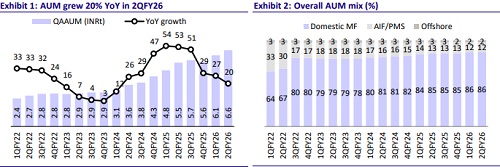

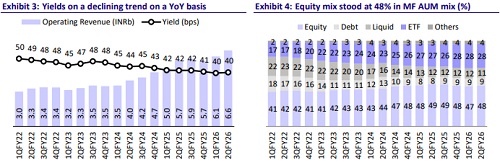

* Nippon Life India AMC’s (NAM) operating revenue grew 15%/9% YoY/QoQ to INR6.6b (in line) in 2QFY26. Yields came in at 40.1bp vs. 41.6bp in 2QFY25 and 39.6bp in 1QFY26. For 1HFY26, revenue grew 18% to INR12.6b.

* Total opex grew 16% YoY to INR2.3b (in line) in 2QFY26. As a result, EBITDA rose 15% YoY to INR4.3b (5% beat) for the quarter. This led to an EBITDA margin of 65.3% vs. 65.5% in 2QFY25.

* NAM’s PAT stood at INR3.4b in 2QFY26 (in-line), down 4%/13% YoY/QoQ. PAT margin stood at 52.3% in 2QFY26 vs 63% in 2QFY25 and 65.2% in 1QFY26. For 1HFY26, PAT grew 7% to INR7.4b.

* Overall yields are expected to decline ~1-2bp annually, primarily due to the telescopic pricing effect. During the quarter, NAM revised commissions for one additional scheme, taking the total number to four, now accounting for nearly 60% of overall equity AUM.

* We broadly retain our earnings estimates, with higher expected yields offsetting the increase in expenses. We reiterate our BUY rating on the stock with a TP of INR1,060, based on 35x Sep’27E EPS.

Market share across categories continues to expand

* Overall MF QAAUM grew 20% YoY/7% QoQ to INR6.6t. The Equity /ETF/ Index/Debt funds grew 17%/24%/34%/38% YoY in 2QFY26.

* NAM’s market share for QAAUM rose 22bp YoY to ~8.5%, with equity market share rising 17bp YoY to ~7.1%. ETF market share continues to surge, rising 160bp YoY to 19.8%, with NAM maintaining a dominant position in this space at 50% of overall industry folios.

* The share of Equity/ETF/Debt/Liquid in the overall QAUM stood at ~47.7%/ 27.9%/9.7%/11.4% in 2QFY26 vs. 49.2%/27.0%/8.4%/12.4% in 2QFY25.

* SIP flows were robust during the quarter at INR107.2b compared to INR90.3b in 2QFY25, reflecting a monthly SIP inflow of INR35.7b (+19% YoY). The SIP book grew to INR1.6t (+11% YoY).

* Operating expenses rose 16% YoY to INR2.3b, with opex as a % of AUM at 13.9% vs 14.3% in 2QFY25 and 14.3% in 1QFY26. Employee costs rose 15% YoY to INR1.2b. ESOP costs for the quarter stood at INR90m, of which INR60m pertained to the new scheme. ESOP costs are estimated at ~INR420m-430m/INR260m for FY26/FY27.

* Other expenses grew 21% YoY/11% QoQ to INR855m. The sequential rise was on account of branding expenses, technology investments, and maintenance costs related to new office establishments.

* Other income came in at INR366m (down 70%/75% YoY/QoQ).

* Under the distribution mix, the retail share improved to 54% in 2QFY26 (vs. 50% in 1QFY26), led by a strong retail investor base. Management expects these levels to be sustained, while the corporate/HNI share was 35%/11%.

* On the product front, NAM launched three new ETF products: Nippon India Nifty One Day Rate Liquidity ETF, Nippon India Nifty India Manufacturing ETF, and Nippon India Nifty India Manufacturing Index Fund.

* NAM’s market share in the industry ETF folio stood at ~50%, while its ETF trading volume share on NSE and BSE was 49%.

* Cumulative AIF commitments reached INR 87.2b as of Sep’25, reflecting a 30% YoY increase; during 2QFY26, NAM raised INR 6.2b across various asset classes. The upcoming product pipeline includes the Nippon India Credit Opportunity AIF Scheme and the Performing Credit Fund.

* On the offshore front, AUM declined to INR161b from INR172b in 2QFY25 and INR166b in 1QFY26 due to geopolitical uncertainties and mark-to-market (MTM) impacts.

* On the GIFT CITY side, NAM operates two feeder funds — Nippon India Large Cap Fund GIFT and Nippon India Nifty 50 Bees GIFT Fund — with combined AUM doubling QoQ to USD31b.The upcoming pipeline includes the Nippon India SHARP Equity Fund and Nippon India Digital Innovation Fund 2B.

* Digital transactions increased 15% YoY in 1HFY26 to 7.8m, contributing 75% of new purchases; notably, 43 new digital purchases/SIPs were initiated every minute during 1HFY26.

Key takeaways from the management commentary

* With respect to the SIF initiative, the team is already in place, and fund launches are in progress. Management highlighted strong inherent demand from the HNI segment and remains highly optimistic about this product category.

* On the offshore front, AUM trended lower due to geopolitical uncertainties and mark-to-market (MTM) impacts. However, management expects a gradual uptick going forward.

* On the debt side, the fixed-income category has started witnessing positive inflows across both short- and long-duration products. With a favorable longterm view on interest rates, NAM expects this momentum to be sustained.

Valuation and view

* NAM, being amongst the fastest-growing AMCs, continues to expand its market share across segments, especially in the passive segment, supported by robust flows, sustained investor stickiness, and new product launches. While yields are expected to decline at a relatively moderate pace, strong net flows are likely to cushion the impact on overall yields.

* We have broadly maintained our earnings estimates, with higher expected yields offsetting the increase in expenses. We reiterate our BUY rating on the stock with a TP of INR1,060, based on 35x Sep’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)