Buy Nestle India Ltd for the Target Rs. 1,410 by Axis Securities Ltd

Strong Topline Growth, Margins Under Pressure; Maintain BUY

Est. Vs. Actual for Q2FY26: Revenue – BEAT; EBITDA – BEAT ; PAT – BEAT

Changes in Estimates post Q2FY26

FY26E/FY27E - Revenue: 2%/2%; EBITDA: 3%/2%; PAT: 6%/4%

Recommendation Rationale

* Stellar Performance: Nestlé posted a healthy ~11% YoY revenue increase, supported by robust double-digit growth in confectionery, beverages, and prepared dishes, alongside solid volume traction in MAGGI noodles. The Milk and Nutrition portfolio remained mixed. EBITDA rose ~6% YoY, though margins compressed by 105 bps to 22%, weighed down by a 216-bps decline in gross margins amid higher input costs and increased operational expenses from capacity expansion.

* Improving Commodity Outlook: As per the management, milk prices are likely to ease post the festive period as the flush season boosts supply. Coffee prices are expected to moderate with normal crop prospects in Vietnam and India. After two years of demand correction, the cocoa market is projected to move toward equilibrium. Meanwhile, edible oil prices are expected to stay elevated, supported by persistent tightness in global supply-demand dynamics.

* GST Revision: The recent reduction in GST rates by the Government of India is expected to enhance consumer affordability, spur demand, and support growth across the FMCG landscape. The company is actively collaborating with its trade partners and channel network to ensure the benefits of these rate cuts are effectively passed on to consumers across all product categories.

Sector Outlook: Positive

Company Outlook: Positive

Current Valuation: 65x Sep’27E EPS (Earlier: 64x Mar’27E EPS)

Current TP: Rs 1,410/share(Earlier TP: Rs 2,580/share)*

(*TP is not comparable as Nestle has issued a bonus share in the ratio of 1:1)

Recommendation: We remain optimistic about the company’s long-term prospects. We maintain our BUY rating on the stock, with a TP of Rs 1,410/share, implying a 10% upside potential from the CMP.

Financial Performance

Nestlé India reported revenue of Rs 5,630 Cr in Q2FY26, reflecting a ~11% YoY growth driven by strong volume growth. Three out of four products delivered strong volume, leading to a doubledigit growth. Gross profit rose 6.7% YoY to Rs 3,052 Cr, although gross margins contracted by 216 bps due to elevated consumption prices. EBITDA improved ~6%YoY to Rs 1,237 Cr; however, margins compressed by 105 bps, owing to gross margin pressure. PAT stood at Rs 753 Cr, down ~24% YoY, impacted by higher depreciation, increased interest cost due to a temporary spike in borrowings, and a sharp decline in other income.

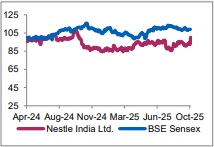

Relative Performance

Outlook

The outlook on Nestlé remains positive from a long-term perspective, as the current demand environment, coupled with recent GST 2.0 reforms, is expected to boost consumption going forward. Additionally, its long-term initiatives include: 1) Efforts toward rural penetration and market share gains through the RURBAN strategy; 2) Constant focus on innovation (launching 125 products in the last seven years), thereby driving growth; 3) Driving premiumisation in core categories (e.g., Maggi noodles range) and launching differentiated products; 4) Entering new categories of the future (e.g., Nespresso, Purina Pet Care, and Gerber’s for toddler nutrition); 5) Introducing a D2C platform to engage consumer attention; 6) Renewed focus on its fast-growing nutraceutical portfolio. The company is well-positioned for long-term growth, with all key levers firmly in place.

Valuation & Recommendation

We expect Nestle's Sales, EBITDA, and PAT to grow at 11%, 14%, and 14% CAGR over CY22-FY28E, respectively. We maintain our BUY stance with a TP of Rs 1,410/share, representing a 10% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)