Buy G R Infraprojects Ltd for the Target Rs. 1,450 by Motilal Oswal Financial Services Ltd

Strong operating performance drives a beat on APAT

Order pipeline remains strong

* G R Infraprojects (GRINFRA) received bonus/claim amounts of INR475m during 4QFY25. For like-to-like comparison, we have adjusted the bonus/claim amounts in revenue and EBITDA for 4QFY25.

* GRINFRA’s revenue dipped 10% YoY to ~INR19.4b in 4QFY25 (9% below our est.). Adj. EBITDA margin stood at 15.5% in 4QFY25 (+160bp YoY) vs. our est. of 11.7%. EBITDA was flat YoY at INR3b and was 21% above our est.

* In line with strong operating performance, GRINFRA’s APAT jumped 27% YoY to ~INR2.9b (39% above our estimate).

* In 4QFY25, it recognized an exceptional gain of INR320m (net of tax). This gain was due to the sale of one operational HAM project to Indus Infra Trust.

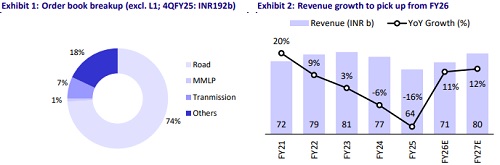

* In FY25, GRINFRA’s revenue was INR64.3b (-16% YoY), EBITDA stood at INR8.2b (-21% YoY), EBITDA margin was 12.7%, and APAT was INR7.2b (+2% YoY).

* The order book currently stands at ~INR192b (excl. L1), with road projects accounting for 74% of the order book. Management expects a 10-15% growth in revenue in FY26 with a margin of ~13-14%. GRINFRA expects an order inflow of INR200b in FY26 as it diversifies into other infrastructure sectors along with a pickup in awarding activity, especially in large-sized projects.

* Strong operating performance in 4QFY25 and an executable order book of INR140b as of May’25 will support revenue growth in FY26. We raise our EPS estimates by 2%/15% for FY26/FY27. We expect GRINFRA to clock a 12% revenue CAGR over FY25-27, with an EBITDA margin in the range of 12-14%. Reiterate BUY with a revised SoTP-based TP of INR1,450.

Order awarding to pick up in FY26, diversification into other infra segments would keep the order book and execution levels healthy

* GRINFRA continued to strengthen its balance sheet during 4QFY25 by repaying INR3.61b in debt, bringing down its debt-equity ratio to 0.07x, one of the lowest in the sector.

* As of Mar’25, the company’s total order book stood at ~INR192b (excl. L1), of which ~INR140b worth of projects were under execution, with several projects nearing completion. A robust pipeline of large infrastructure projects is expected to support healthy order inflows in the coming quarters.

* GRINFRA reported INR80b of order inflow in FY25 (excl. L1) and has set a target of INR200b for FY26. Within this, highways are expected to contribute INR110b. The company also plans to consistently target INR30–40b of new BoT projects annually.

Key takeaways from the management commentary

* Total equity invested in HAM projects to date stands at INR20b, with the remaining contribution of INR28.75b to be infused across FY26–FY28.

* Order inflow in FY25 (excl. L1) stood at INR80b. The company targets 2.5x that level (i.e., ~INR200b) in FY26, driven by a pickup in BoT project activity and large project awards.

* The company recently entered the optical fiber cable (OFC) segment with margin expectations of ~10%, expanding beyond highways, ropeways, railways, power, and transmission sectors.

* Looking ahead, GRINFRA expects double-digit revenue growth in the range of 10-15% in FY26. The company continues to diversify beyond roads, expanding into sectors such as ropeways, power transmission, railways, metro, and telecom. Capex for FY26 and FY27 is expected to be INR1.0–1.3b annually

Valuation and view

* GRINFRA is strategically positioned for steady growth and diversification, backed by a strong balance sheet, robust order book, and an evolving sectoral presence. It has significantly strengthened its financial position by reducing its debt

* Pickup in executable order book and robust tender pipeline: We expect GRINFRA to clock a 12% revenue CAGR over FY25-27, with an EBITDA margin in the range of 12-14%. Reiterate BUY with a revised SoTP-based TP of INR1,450.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412