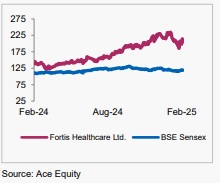

Buy Fortis Healthcare Ltd For the Target Rs. 860 By the Axis Securites

Recommendation Rationale

Strong Revenue Growth Driven by Hospitals: Fortis Healthcare reported revenue of Rs 1,623 Cr, up 16.8% YoY and 8.9% QoQ, supported by higher ARPOB and improved occupancy levels.

Stable ARPOB and Improved Occupancy: ARPOB stood at Rs 67,123, up 9.9% YoY, while occupancy improved to 67% (up 300 bps YoY), driven by a 4.3% YoY growth in occupied bed days. EBITDA margins stood at 20%, up 200 bps YoY.

Agilus Diagnostics: Agilus reported muted growth of 5.2% YoY, with EBITDA of Rs 49 Cr, reflecting a 16.1% margin, up 450 bps YoY

Sector Outlook: Positive

Company Outlook & Guidance: Fortis Healthcare remains focused on profitable growth, leveraging brownfield expansions, operational efficiencies, and portfolio optimisation. The company targets 14-15% revenue growth in the hospital business, with ARPOB expected to grow at 5-6% YoY. Hospital EBITDA margins are projected at 20.5% for FY25, with a long-term goal of reaching 25% through higher occupancy and improvements in the specialty mix.

Current Valuation: EV/EBITDA 27x for FY27E EBITDA

Current TP: Rs 860/share (Earlier TP: Rs 860/share)

Recommendation: BUY

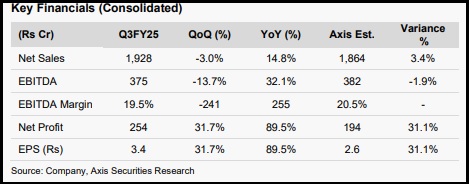

Financial Performance Fortis Healthcare reported revenue of Rs 1,928 Cr, which is in line with expectations and supported by higher ARPOB and improved occupancy levels. ARPOB stood at Rs 67,123, up 9.9% YoY, while occupancy improved to 67% (up 300 bps YoY), driven by a 4.3% YoY growth in occupied bed days. Hospital Segment EBITDA margins stood at 20%, up 200 bps YoY. The rebranded Agilus Diagnostics reported muted growth of 5.2% YoY, with EBITDA of Rs 49 Cr, reflecting a 16.1% margin, up 450 bps YoY. The company’s topline grew by 14.8% YoY, while overall EBITDA margins stood at 19.5%, down 241 bps QoQ but showing an annual improvement of 255 bps. The reported PAT was Rs 254 Cr, including an exceptional gain of Rs 24 Cr from the divestment of Richmond Road Hospital, Bangalore. Adjusted PAT grew 71.6% YoY, driven by operational efficiencies and cost control.

Financial Performance The 9.9% rise in ARPOB was primarily driven by an improved payer and case mix. During the quarter, the international patient segment reported revenue of Rs 132 Cr, up 17% YoY, contributing 8% to total revenue. Key specialties delivered strong performance, contributing 62% of total hospital revenue (up from 61% YoY). Oncology grew 30% YoY, led by a 44% increase in haematology and bone marrow transplants, while neurosciences saw 18% growth. Robotic surgeries surged 77%, reflecting the company’s focus on advanced procedures, with cardiac sciences, gastroenterology, orthopaedics, and renal sciences also showing robust expansion. Fortis Healthcare has increased its stake in Agilus Diagnostics to 89.2%, following the acquisition of a 31.52% stake from private equity investors in January 2025. The rebranding costs impacted margins and are expected to taper off by Q4FY25, positioning Agilus for improved profitability. The company targets 8-10% revenue growth in Agilus by Q2 FY26, driven by network expansion, a focus on preventive care, and higher specialised testing volumes. Fortis Healthcare continues its expansion with a brownfield addition of 400+ beds planned for FY26, maintaining a growth trajectory of 350-400 beds/year. The Manesar Greenfield facility started with 53 operational beds and is set to break even by Q1FY26 as capacity ramps up. In Q3 FY25, Rs 900 Cr was earmarked for expansion and facility upgrades, including Rs 600 Cr for new capacity and Rs 300 Cr for maintenance. At the same time, net debt stands at Rs 2,000 Cr, post-private equity buyout, with a Net Debt/EBITDA ratio of 0.41x.

Outlook Fortis Healthcare remains focused on profitable growth, leveraging brownfield expansions, operational efficiencies, and portfolio optimisation. The company targets 14-15% revenue growth in the hospital business, with ARPOB expected to grow at 5-6% YoY. Hospital EBITDA margins are projected at 20.5% for FY25, with a long-term goal of reaching 25% through higher occupancy and improvements in the specialty mix. For Agilus Diagnostics, Fortis expects revenue growth to normalise at 8-10% by Q2 FY26 as rebranding costs taper off. The company maintains a strong balance sheet, with a Net Debt/EBITDA ratio of 0.41x, ensuring financial flexibility for expansion and strategic investments.

Valuation & Recommendation As one of India’s leading hospital chains, Fortis Healthcare is well-positioned to capitalise on rising healthcare demand, supported by strong specialty growth, operational efficiencies, and strategic capacity expansion. The brownfield expansion of 400+ beds in FY26 and the ramp-up of the Manesar Greenfield facility are expected to drive incremental revenue growth and margin expansion. Additionally, Fortis' higher ARPOB, improved payer mix, and focus on specialty care should further strengthen its profitability. We maintain a BUY rating on Fortis Healthcare with a target price of Rs 860/share, reflecting strong upside potential. This valuation is based on a 25x EV/EBITDA multiple for FY27E, factoring in sustained revenue growth and long-term margin expansion.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633