Buy Cello World Ltd For the Target Rs. 770 By PL Capital- Prabhudas Lilladher

Widening TAM to drive growth

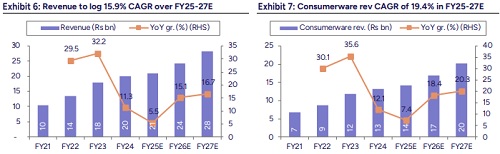

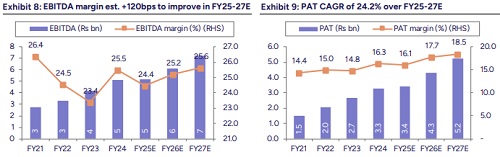

We initiate coverage on Cello World (CELLO) with a ‘BUY’ rating and SOTPbased TP of Rs770 valuing its Consumerware business at 37x FY27EPS, which implies 33x FY27E earnings. Cello World is a leading Indian consumer product company mainly dealing in consumer houseware, glassware, writing instruments, and molded furniture. We believe CELLO is well-positioned for growth across its segments given its 1) strong brand and diversified product portfolio, 2) proven track record of scaling new businesses and product categories, 3) plans to explore inorganic growth opportunities and 4) skilled and experienced management team. We estimate revenue/EBITDA/PAT CAGR of 15.9%/18.7%/24.2% over FY25-27E led by 1) improving business/product mix, 2) various sector-specific tailwinds, and 2) recent capacity expansions in opalware and glassware segments. Initiate ‘BUY’

* Diversified business – Leveraging TAM opportunity:

CELLO’s diversified product portfolio spans consumerware, writing instruments, and molded furniture. TAM is expected to clock 13.4% CAGR to reach Rs1,080bn by FY27E from Rs653bn in FY23. This diversification provides resilience and allows CELLO to capitalize on high-growth areas like glassware, which is expected to grow at 15.8% CAGR. With a broad portfolio of over 17,000 SKUs and continuous product innovation, CELLO targets new customer segments to enhance market share. Strategic focus on products, strong distribution network, and competitive pricing have helped strengthen its market position. CELLO’s Consumer Ware segment (contributes >66% to revenue) reported 25.5% revenue CAGR against peers Borosil/La Opala of 34.8%/20.0% over FY21-24 and is expected to log 19.4% CAGR over FY25-27E.

* Strong brand presence with extensive distribution network:

CELLO is a leader in the branded consumerware industry with ~5% market share and has built strong brand recall through a wide range of high-quality, competitively priced products. The company invests significantly in branding and promotional activities, utilizing various marketing strategies to enhance visibility. CELLO’s extensive pan-India distribution network, with 3,500+ distributors and 1,45,000+ retailers, plays a vital role in driving growth. With continuous innovation, growing digital presence, and operational agility, CELLO is well-positioned for sustained growth.

* In-house manufacturing, capacity expansion to drive growth:

CELLO’s inhouse manufacturing, which accounted for 77.8%/77.2% sales in FY24/9MFY25, enables quick production scaling, faster product launches, quality control, and reduced supply chain risks. Recent capacity expansions in glassware/opalware facilities in Rajasthan/Daman, will help strengthen production capabilities and reduce reliance on imports. With significant installed capacity across multiple product categories, we expect CELLO to report revenue/PAT CAGR of 15.9%/24.2% over FY25-27E.

* Inorganic opportunities to drive profitability:

CELLO recently announced the merger of Wim Plast Ltd (WPL) to leverage synergies from latter’s manufacturing facilities. CELLO is also exploring inorganic growth opportunities, including acquiring companies to complement its product lines.

Above views are of the author and not of the website kindly read disclaimer