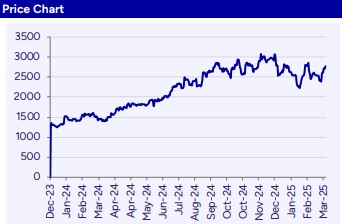

Buy DOMS Industries Ltd For the Target Rs. 3,370 By PL Capital- Prabhudas Lilladher

Backward integration prowess at display

Quick Pointers:

* Expansion plan at the new 44-acre land parcel is progressing as per schedule

We visited the production facility of DOMS at Umbergaon in Gujarat and interacted with the top management to get an update over ongoing expansion plan. Progress at the new 44-acre land parcel is satisfactory (check exhibit 1) and first building is expected to be ready by 3QFY26E. Onsite survey of the existing facility indicates true competitive edge of DOMS stems from full backward integration capabilities in core categories like pencils, sketch pens and mathematical instrument boxes. Further, a lot of new products like finger paints (check exhibit 2), floating markers (check exhibit 3) and water-based gum were at display on the shop floor indicating innovation continues to take center stage at DOMS. Led by product innovation, capacity expansion in categories like pencils & pens and strengthening of the distribution network we expect sales/PAT CAGR of 27% over FY25E-FY27E. We broadly maintain our estimates and retain BUY on the stock with a TP of Rs3,370 (60x FY27E EPS; no change in target multiple).

Progress at new site is on track:

Progress over the new development plan on 44- acres land parcel in Umbergaon is on track and first building is expected to be ready by 3QFY26E. Construction work at adjoining buildings within the new land parcel was also evident. Further, there are plans to buy additional 2-acres of land at the new site. Overall, development of ~1.8-2mn sq ft of area is planned at the new site entailing a capex of ~Rs9-10bn.

Innovation and category expansion continues:

A lot of new and innovative products were at display on the shop floor. For instance, DOMS has recently launched a new finger paints product, floating markers and water-based gum. In adhesives, ergonomically designed bottles priced at Rs5-10 have also been launched. In addition, DOMS has also entered into an distribution agreement with FILA to export branded stationery products in markets where FILA already has an established presence opening up a new avenue for growth. Further, there are plans to expand capacity of mechanical pencils while a new line for wet wipes is expected to begin operations soon. Product innovation and category expansion is likely to drive top-line at a CAGR of 27% over FY25E-FY27E.

Capacity expansion in pens and pencils to drive growth:

Plans to expand manufacturing capacity of pencils by 2.5mn pieces per day is on track. After the recent capacity expansion in pens by 1mn pieces per day, launch of new SKUs and expansion of distribution network (pan-India reach now), we expect the category to be a key growth lever for DOMS.

Outlook & valuation:

Led by ongoing expansion of product basket (SKU count has increased from 3,800 in 3QFY24 to 4,350 in 3QFY25) and distribution network (retail touch points have increased from 122,500 in 3QFY24 to 140,000 in 3QFY25), we expect sales and PAT CAGR of 27% over FY25E-FY27E. Retain BUY on the stock with a TP of Rs3,370 (60x FY27E EPS).

Above views are of the author and not of the website kindly read disclaimer