Buy Dr. Agarwal’s Health Care Ltd for the Target Rs. 600 by Motilal Oswal Financial Services Ltd

Strong operational momentum continues

Comprehensive strategy keeps earnings outlook intact

* Dr. Agarwal Health Care’s (DAHL) 2QFY26 revenue was in line with our expectation, whereas EBITDA/PAT came in 5%/11% above our estimates. Robust growth in surgeries and opitcals/pharmacy products was supported by better realization.

* DAHL witnessed strong 24% YoY growth in terms of patients served at clinics and surgery centers. To support this growth, DAHL added 44 doctors YoY, taking the cumulative number to 881 doctors.

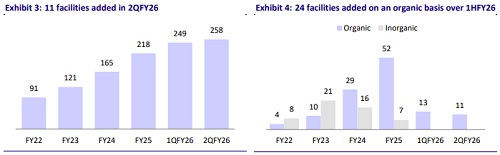

* DAHL also expanded its infrastructure by adding 49 facilities in 1HFY26 and increasing its presence to 141 cities as of 1HFY26 from 129 as of FY25.

* The premiumization of services and an increased share of high-end surgeries led to 8% YoY growth in revenue per surgery for the quarter.

* Though DAHL’s 2Q performance was better than our estimates, we maintain our estimates for FY26/FY27/FY28. For FY26, though 2H would be better than 1H in terms of revenue, the pre-opex is expected to increase due to the addition of surgical centers.

* We expect 44% earnings CAGR over FY25-28, led by 19% CAGR in surgeries, 17% CAGR in opticals/pharmacy products and 70bp margin expansion.

* We value DAHL on an SoTP basis (25x EV/EBITDA for the surgery business, 15x EV/EBITDA for the opticals business, 13x EV/EBITDA for the pharmacy business, adj for a stake in Dr. Agarwal eye hospital/Thind hospital) and arrive at a TP of INR600. Maintain BUY.

Superior margins backed by favorable surgery mix and better operational efficiency

* 2Q revenue grew 19.7% YoY to INR5.0b (in line).

* India revenue rose 19.8% YoY to INR4.4b, contributing 89% of total revenue. International revenue grew 18.9% YoY to INR454m (11% of total revenue).

* Mature facilities reported 12.7% YoY growth to INR3.7b (83% of revenue), while new facilities delivered a strong 75% YoY growth to INR0.7b.

* EBITDA margin expanded 160bp YoY to 27.3% (our estimate: 26.2%), driven primarily by lower raw material costs (down 90bp YoY as % of sales) and employee expenses (down 70bp YoY).

* Consequently, EBITDA grew 27.3% YoY to INR1.36b (our estimate: INR1.3b).

* PAT came in at INR297m in 2QFY26, up from INR165m in 2QFY25, backed by improved operational performance, low finance costs, and a reduced tax rate.

* For 1HFY26, revenue/EBITDA/PAT grew 20%/25%/108% YoY, driven by facility expansion and operational efficiencies.

* DAHL added 24 new centers in 1HFY26, expanding its network to 258 facilities, while surgeries increased 14.6% YoY to 157,281 during the same period.

* Service sales accounted for 78% of total revenue, whereas product sales contributed 22% in 1HFY26.

Highlights from the management commentary

* High-end cataract and refractive surgeries led mix improvement, driving up average revenue per surgery by ~5-6% on YoY basis.

* DAHL added 24 new facilities in 1HFY26 (13 in 1Q/11 in 2Q) and now operates 258 centers (239 in India, 19 overseas).

* Of the 11 centers added in 2Q, six were secondary hospitals (Sivakasi, Tenkasi, Bhopal, Aurangabad, Palakkad, Hassan) and five were primary centers (two in Belgaum, one each in Gadag, Haveri, Jhattakuda).

* 123 mature facilities (3+ years old) reported 13.4% YoY growth, contributing 75% of total revenue.

* FY26 capex is maintained at INR3b (+INR700m for flagship); about 30 new centers to be launched in 2HFY26.

* 2HFY26 is expected to be stronger on seasonality; management is confident of sustaining growth momentum in 2H as well.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)