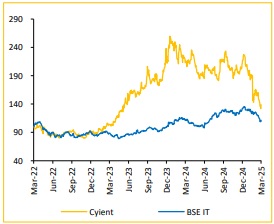

Buy Cyient Ltd For the Target Rs. 1,660 by Choice Broking Ltd

Analyzing Q3 Results amid Leadership Changes, Trump Tariffs & Macroeconomic Challenges

Cyient Revenue above estimates, EBIT & PAT missed expectations.

* Revenue for Q3FY25 came at INR 19.2Bn up 5.8% YoY and 4.2% QoQ (vs consensus est. at INR 18.5Bn).

* EBIT for Q3FY25 came at INR 2.1Bn, down 18.7% YoY and 8.4% QoQ (vs consensus est. at INR 2.4Bn). EBIT margin was down 330bps YoY and 150bps QoQ to 11.0% (vs consensus est. at 12.9%).

* PAT for Q3FY25 stood at INR 1.2Bn, down 12.8% YoY and 31.2% QoQ (vs consensus est. at INR 1.7Bn).

Cyient Appoints Industry Veterans Mr. Sukamal Banerjee as CEO & ED and Mr. K.A. Prabhakaran as SVP & CTO to Drive Innovation and Growth: Mr. Sukamal Banerjee brings over 27 years of experience, including his role as CEO at Xoriant and leadership in digital engineering at HCLT, Banerjee has expertise in Digital Industry 4.0, AI/ML, and sectors like communications, energy, transportation, and healthcare. His leadership is seen as a strategic move to guide Cyient DET (Digital, Engineering & Technology) following the previous CEO's resignation. We are eager for his vision to revitalize growth. Additionally, K.A. Prabhakaran will join as SVP and CTO, effective March 10, 2025. With 30+ years of experience in engineering and R&D across industries like Aerospace and Oil & Gas, Prabhakaran will focus on innovative solutions for organic growth. Notably, he has expertise in building technology solutions for large OEMs in areas like avionics.

DET business soars with record $312.3Mn order intake and strong growth prospects: Cyient's DET business achieved a record order intake of $312.3Mn in Q3FY25, marking a 5.0% YoY growth, although the tenure of purchase orders was shorter this year. Additionally, the company secured 13 large deals within the DET segment during the quarter, totalling $234.5Mn in contract potential. These wins contributed to a 2.4% QoQ revenue growth in Q3FY25. However, their late timing limited their immediate effect on Q4FY25 revenue. Despite this, the strong order book, combined with the establishment of a new large deal function, improvements in sales efficiency, a focus on value-based selling, and a performance framework incentivizing revenue growth, strengthens confidence for FY26 revenue growth. Furthermore, the management highlighted a positive outlook due to improved client spending sentiment in key verticals, reinforcing the optimism for continued growth moving forward.

Potential slowdown in IT spends amid Trump tariffs: Cyient could encounter revenue challenges due to uncertainty over the Fed's interest rate decisions and concerns about a potential US economic slowdown. With 50% of its revenue from North America, reduced IT spending or delayed contract renewals in key sectors may impact growth. Currency volatility also poses margin risks, though easing inflation and stable tariffs could boost demand.

View and Valuation: Following recent major changes in senior management and the uncertainties surrounding the US economy, we believe that most of the negatives have already been priced in. Under new leadership, we anticipate the company is now poised to thrive and improve its performance in the favorable environment ahead. Given Cyient's significant exposure to the US market and the transition in its senior management, we maintain our 'BUY' rating but have lowered our target price to INR1,665. This adjustment is based on a downward revised PE multiple of 20x, based on FY27E EPS of INR83.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131