Buy Container Corporation Ltd for the Target Rs. 670 by Motilal Oswal Financial Services Ltd

Steady 2Q; volume growth likely to improve

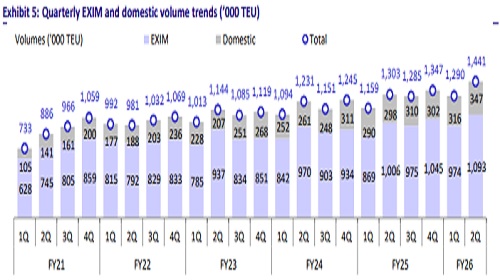

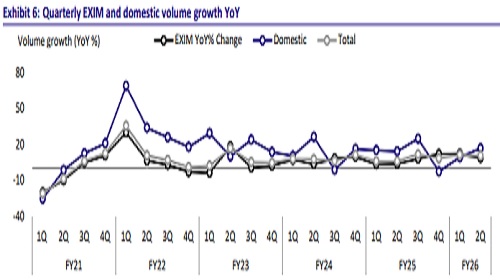

* Container Corporation (CCRI)’s 2QFY26 revenue grew 3% YoY to INR23.5b (in line). Total volumes grew 11% YoY to 1.4m TEUs, with EXIM/domestic volumes at 0.109m/0.34m TEUs (+9%/+17% YoY). Blended realization dipped ~7% YoY to INR16,321/TEU. EXIM/Domestic realization stood at INR14,426/ INR22,286 per TEU (-5%/-12% YoY).

* EBITDA margins came in at 24.2% (v/s our estimate of 21.6%). EBITDA declined ~1% YoY and was 12% above our estimate.

* The land License fee for 1HFY26 stood at INR2.16b.

* During the quarter ended Jun’25, the company reviewed and revised the estimated useful life of its LNG trucks and trailers. Consequently, the useful life of these assets has been extended to 15 years from 8 years. As a result, depreciation on LNG trucks and trailers stood at ~INR15.2m in 2Q – a reduction of INR30.9m in 1HFY26. This change led to a corresponding increase in PBT by INR30.9m for 1HFY26.

* The Board declared a dividend of INR2.6 per equity share, amounting to INR1.98b.

* CCRI delivered a steady operational performance in 2QFY26, marked by healthy volume growth; however, lower realizations in the EXIM and domestic segments were unfavorable. The company faced challenges such as subdued demand in cement due to the extended monsoon, which also affected domestic volume growth.

* We broadly maintain our estimates for FY26 and FY27, factoring in lower realization in EXIM/domestic business and a delay in DFC connection to Mar’26. We further roll forward our valuation to FY28. We expect its revenue/ EBITDA to clock a CAGR of 13%/16% over FY25-FY28. We reiterate our BUY rating with a TP of INR670 (based on 15x EV/EBITDA on FY28E).

Key highlights from the management commentary

* CCRI’s LLF stood at INR2.16b in 1HFY26. The company continues to evaluate and surrender underutilized land parcels to rationalize LLF, which is expected to remain at FY25 levels during FY26.

* Delays in the delivery of specialized tank containers, which were hurting domestic volumes, are running smoothly with the delivery of 200 containers. CCRI has placed an order for 1,000 units (in two tranches of 500), of which 700 have been received, and the balance will be delivered in the near future.

* The originating volume for EXIM/Domestic stood at 0.58m/0.13m TEUs.

* Management sees a significant opportunity in cement container transport, as only ~10% of cement is currently transported by rail, with the balance moving by road. The company has signed MoUs with Ultratech and Adani Cement to transport 1 lakh tonnes of cement per month, with each of them to tap this opportunity.

* For FY26, CCRI has maintained its guidance of 13% growth in total volumes, with 10%/20% growth in EXIM/domestic volumes.

Valuation and view

* CCRI strengthened its logistics ecosystem by expanding double-stack rail operations, shipping operations in the Middle East, utilizing the Dedicated Freight Corridor to drive efficiency, and advancing its integrated logistics network. The company remains focused on scaling its rail freight services and infrastructure, supported by a higher capex allocation toward new terminal commissioning, fleet augmentation, and enhanced multimodal connectivity.

* We broadly maintain our estimates for FY26 and FY27, factoring in lower realization in EXIM/domestic business and delay in DFC connection, and roll forward our valuation to FY28. We expect its revenue/ EBITDA to clock a CAGR of 13%/16% over FY25-FY28. We reiterate our BUY rating with a TP of INR670 (based on 15x EV/EBITDA on FY28E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)