Buy Cello World Ltd for the Target Rs. 720 by Motilal Oswal Financial Services Ltd

Festive-led momentum supports growth

Earnings in line with estimates

* Cello World (CELLO) reported a healthy revenue growth of ~20%, largely led by a 23% YoY growth in the consumerware segment. The writing instrument segment also witnessed a healthy recovery (up 17%) after a five-quarter decline. Growth was supported by a healthy uptake across key categories in the festive season.

* The company maintained its FY26 growth guidance of ~12-15% for revenue and ~22-23% for EBITDA margin, implying a 14%/18% revenue/EBITDA growth for 2HFY26. This is expected to be supported by the ramping up of the glassware facility, commissioning of the steelware plant, and demand recovery.

* We largely maintain our FY26/27/28 earnings estimates and reiterate our BUY rating with a TP of INR720 (premised on 30x Sept’27E EPS).

Margin pressure persists amid cost inflation and supply constraints

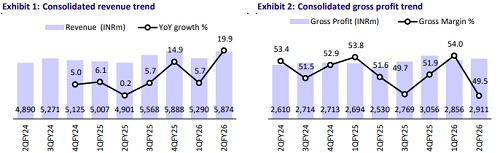

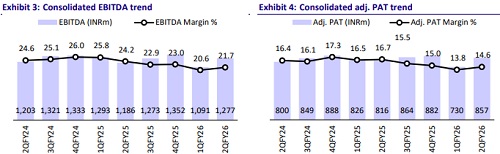

* In 2QFY26, CELLO's consolidated revenue grew 20% YoY/11% QoQ to INR5.9b (est. INR 5.6b). EBITDA grew ~8%/11% YoY/QoQ to INR1.3b (est. in line).

* EBITDA margin contracted 250bp YoY, largely due to higher employee/other expenses rising 210bp/60bp YoY, while it expanded 110bp QoQ to 21.7%. Gross margin contracted 210bp/440bp YoY/QoQ to 49.5%. The higher costs were driven by the inability to raise prices, increased energy and wage expenses from the new glassware facility, and supply constraints at the steelware facility.

* Adj. PAT grew 5%/17% YoY/QoQ to INR857m (est. in line).

* Consumerware segment’s revenue (72% of total revenue in 2QFY26) grew 23%/15% YoY/QoQ to INR4.2b. Gross margin contracted 230bp YoY.

* Writing instrument segment’s revenue (~14% revenue mix) grew 17% YoY/11% QoQ to INR817m. Further, molded furniture and allied products (~14% of the revenue mix) grew 8% YoY, while they declined 6% QoQ to INR842m. The gross margin of writing instruments expanded 60bp YoY, while that of molded furniture and allied products declined 440bp YoY.

Highlights from the management commentary

* Guidance: Capex is expected to be ~INR1.5b for FY26 (majorly for steel flask), including INR750m for maintenance. Further, the company expects performance to be better in FY27, driven by the glassware and steelware plants.

* Acquiring Cello brand: Cello Plastic Industrial Works (CPIW), CELLO’s promoter entity, is reacquiring the Cello trademark from the BIC Group for its writing instruments and stationery segment. With existing capacity in place, no major capex is expected. Revenue under the Cello brand is expected to begin in Jan’26, while the Unomax brand will continue to be marketed as well.

* Glassware: Glassware capacity utilization reached 60% in 2QFY26, achieving breakeven; profits are expected ahead. The company plans to expand its range to 150 SKUs (from 110).

Valuation and view

* The consumerware segment is expected to maintain its current growth rate, with incremental growth driven by the ramp-up of the glassware facility and the commissioning of the steelware facility, which should also support improved margins. Meanwhile, the healthy growth momentum in the writing instruments segment is expected to continue in the coming quarter, supported by improving demand in both export and domestic markets.

* We expect CELLO to register 15%/17%/19% revenue/EBITDA/Adj. PAT CAGR over FY25-28. We reiterate our BUY rating with a TP of INR720 (premised on 30x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412