Buy Birla Corporation Ltd for the Target Rs. 1,650 by Choice Broking Ltd

Business Overview:

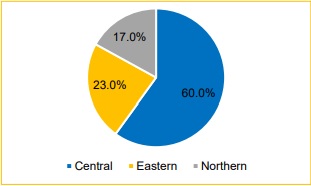

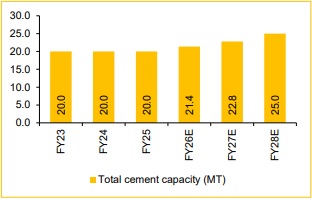

BCORP, the flagship company of the M.P. Birla Group, is a leading cement manufacturer in India with operations across northern, central, and eastern regions. The company has a current capacity of ~20 MTPA and plans to expand to ~27.6 MTPA by FY29E through brownfield and greenfield projects. It has strengthened its balance sheet by reducing debt and recently secured a limestone mining lease in Rajasthan. Apart from cement, it also operates in jute, linoleum, and auto trim segments, though cement remains the core business.

Elaborate on BCORP’s upcoming capacity expansion in terms of scale, capital efficiency, and funding strategy, and how BCORP plans to ensure balance sheet strength during this growth phase. How does the company plan to ramp up capacity utilisation after expansion?

BCORP is undertaking a robust capacity expansion program, targeting a ~38% increase in cement capacity, from 20 MTPA in FY25 to ~27.6 MTPA by FY29E. The project is being executed at a highly competitive capital cost of USD 67/tonne, while maintaining financial prudence, with net debt-to-EBITDA expected to remain below 2x. This expansion positions the company well for long-term growth, with our assumptions already factoring in 5 MTPA slated for commissioning in FY28E.

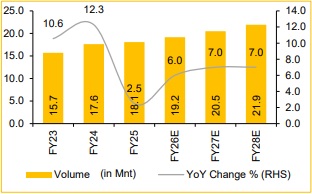

Strategically, BCORP’s expanded capacity in central and northern markets will enable it to consolidate share in the core regions, while the eastern market — where demand growth is structurally higher than the industry average — will be an important lever for volume ramp-up. Additionally, improved logistics, deeper trade channel penetration, and a stronger premium product portfolio will support faster absorption of capacity.

With cost pressure from clinker purchase, plant shutdowns and rising employee costs, how is BCORP positioning itself for margin recovery and long-term growth?

Margin improvement is expected as external clinker purchases phase out and volumes from Mukutban normalize. The company is shifting towards value-led growth by reducing non-trade sales, increasing blended cement and strengthening its premium portfolio — premium share in Mukutban has already risen from 40% to 50%. While employee costs were higher due to increments and lower absorption on weak volumes, this pressure should ease with improving utilisation. On growth, BCORP has earmarked INR 10–11Bn capex for the year, including commissioning of the Kundangunj line, and remains open to M&A opportunities to enhance its long-term positioning.

Outlook:

We arrive at a 1-year forward target price (TP) of INR 1,650/share for BCORP. We now value the company using our EV/Capital Employed (EV/CE) framework, assigning a multiple of 1.1x for both, FY27E and FY28E, which we believe is conservative given the doubling of ROCE (ex-CWIP), from 6.2% in FY25 to 13.3% in FY28E, under reasonable operational assumptions.

Risks:

* Profitability risk from potential dependence on high-cost external clinker purchases during operational disruptions

* Competitive risk from limited capacity expansion before 2027, restricting market share gains against fastergrowing peers

Strategic foray into the central region

Targeting ~25 Mnt cement capacity by FY28E

Volume expected to reach 21.9 Mnt in FY28E???????

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131