Buy Bank of Baroda Ltd For Target Rs. 330 By Emkay Global Financial Services Ltd

Bank of Baroda (BoB), yet again, reported better credit growth (12% YoY) along with improved margin (up by 5bps vs flat-to-minor contraction for peers). This, coupled with lower staff cost and contained provisions, led to nearly inline PAT at Rs48bn/1.1% RoA. For the bank, credit growth is mainly driven by retail and overseas credit, while the management has given guidance for credit growth sustaining at around current levels. Margin expansion of 5bps QoQ in 2Q to 2.96% was mainly driven by better LDR and higher interest on the IT refund (a 6-7bps benefit), while the bank retains its FY26 NIM at a broad range of 2.85-3.0%. Headline asset quality too improved, with no lumpy corporate NPA in 2Q; the bank carries floating provision of Rs10bn/0.1% of loans (Rs4bn made in Q2, considering potential migration to the ECL framework). BoB expects a modest ~75bps net impact on CET 1 from the draft ECL and capital charge guidelines. We finetune our earnings estimates, while retaining BUY; we boost our TP by ~18% to Rs330 (from Rs280 earlier), rolling forward on standalone bank at 1x Sep-27E ABV and subs/investments at Rs15/sh. We remain positive on PSBs in general, as also on BoB, given its healthy return ratios, capital buffer, stable management team, and reasonable valuations.

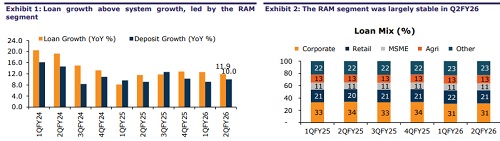

Strong growth; NIM improves QoQ

BoB reported strong credit growth at 12% YoY/6% QoQ, well above system credit, driven by sustained momentum in the RAM segment and overseas credit. Within retail, growth was broad-based across segments, with housing, auto, PL, and GL reporting healthy growth of 17-23% YoY. Deposit growth too was healthy, at 10% YoY/4.5% QoQ, while CASA ratio declined by 100bps QoQ to 38%. Better LDR (84% in Q2, up by 124bps QoQ), higher interest on IT refund (6-7bps QoQ benefit), and benefit of deposit repricing led to a 5bps QoQ margin expansion to 2.96%, in contrast to margin compression seen among peers (except INBK). The mgmt expects the momentum to sustain in the RAM segment and corporate growth to pick up in H2; hence, it has given guidance for overall credit growth of 11-13% in FY26 and expects margins to be range-bound in H2.

Headline asset quality improves in absence of any lumpy corporate NPA

Gross slippages were contained at Rs30.6bn/1.1% of loans which, coupled with better recoveries/write-offs, led to a 12bps QoQ improvement in GNPA ratio to 2.2%. NNPA ratio was broadly sticky at ~0.6%, with PCR at 74%. Further, BoB carries floating provision of Rs10bn/0.1% of loans, with Rs4bn made in Q2 as a prudent measure, given the potential migration to the ECL framework. BoB anticipates a ~125bps impact overall on CRAR from the draft ECL regulations, partially offset by a 60-70bps benefit from the proposed capital charge guidelines, resulting in a modest net impact of ~75bps. The SMA pool maintained the comfortable levels of 0.4% of loans.

We retain BUY; take comfort from bank’s healthy RoAs, lower valuations

We finetune our earnings estimates, while retaining BUY and lifting our TP to Rs330 (from Rs280), rolling forward on the SA bank at 1x Sep-27E ABV and subs/investments at Rs15/sh. Key risks: Macro slowdown leading to slower credit growth, higher margin contraction, and asset-quality disruption – particularly in the SME space.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354