Buy Ashok Leyland Ltd For the Target Rs. 245 By the Axis Securites

Recommendation Rationale

Company Growth Outlook: Ashok Leyland is advancing toward its medium-term targets, including mid-teen EBITDA margins, 35% MHCV market share, non-MHCV business expansion, alternate fuel leadership, and value unlocking from subsidiaries. The company is seeing growth in tippers, multi-axle products, and has a strong order book for electric vehicles under Switch. Non-CV businesses such as engines and spare parts have seen 3.5%/14% YoY growth, respectively.

Export Outlook: Exports remain a key growth driver for the company, with Q3FY25 export volumes up 33% YoY. FY25 export volumes are projected at 15,000 units, up from 11,800 in FY24. The company is on track to meet its medium-term target of 25,000 units. It has also set a long-term goal of 50,000 units annually, supported by localisation efforts and improving market conditions in GCC, SAARC, and Africa. Investments in assembly facilities and local market operations have further strengthened the company’s presence in these key regions.

Healthy EBITDA Margins: Q3FY25 EBITDA stood at Rs 1,211 Cr with margins improving to 12.8% (up 77 bps YoY). The margin expansion was fueled by cost reduction initiatives (~Rs 650 Cr annually), a stronger product mix (higher share of tippers and multi-axle trucks), and relatively stable commodity prices. Looking ahead, continued premiumisation, operational efficiencies, and growth in high-margin non-CV businesses should further strengthen EBITDA margins, keeping the company on course for its mid-teen margin target.

Sector Outlook: Cautiously Positive

Company Outlook & Guidance: AL is focused on gaining CV market share by improving its domestic presence and meeting customers’ requirements by investing in the non-auto side of its business and product development, including diverse powertrain technologies. Further, optimising operational efficiencies, material cost reduction efforts, and pricing discipline are expected to generate strong positive cash flows.

Current Valuation: 18x P/E on FY27E EPS and Rs 21/share for stake in HLF Ltd.(unchanged)

Current TP: Rs 245/share (earlier Rs 250/share)

Recommendation: We maintain our BUY rating on the stock.

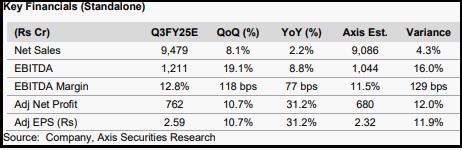

Financial Performance: In Q3FY25, Ashok Leyland’s Revenue/EBITDA/PAT beat our estimates. Revenue was at Rs 9,479 Cr (Beat), up 2.2%/8.1% YoY/QoQ, despite a 1.8% drop in volumes YoY due to higher ASP, uptick in higher tonnage vehicles and pricing discipline in terms of discounting. EBITDA (Beat) stood at Rs 1,211 Cr, up 8.8%/19.1% YoY/QoQ, on account of cost control measures and a richer product mix. EBITDA Margins were 12.8%, up 77bps/118bps YoY/QoQ. PAT (Beat) stood at Rs 762 Cr, up 31.2%/10.7% YoY/QoQ, largely following the EBITDA and lower effective tax rate.

Outlook

We remain positive on the long-term prospects of AL, factoring in recovery in MHCV industry momentum and product diversification. We, therefore, arrive at a sustainable long term volume guidance of 4.3% CAGR volume growth over FY24-27E. We estimate AL to post Revenue/EBITDA/PAT growth of 4%/7%/11% CAGR over FY24-27E.

Valuation & Recommendation We maintain our BUY rating on the stock with the TP at Rs 245/share (earlier Rs 250/share); valuing the stock at 18x P/E on FY27E EPS (unchanged) and assign Rs 21/share for stake in Hinduja Leyland Finance Ltd.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633