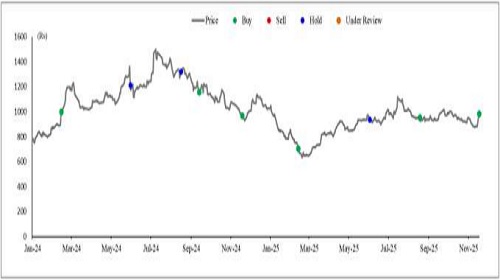

Buy Ahluwalia Contracts India Ltd For Target Rs. 1,085 By Axis Securities Ltd

Robust Operating Performance Delivered; Maintain BUY

Est. vs. Actual for Q2FY26: Revenue – BEAT; EBITDA Margin – BEAT ; PAT – BEAT

Change in Estimates post Q2FY26

FY26E/FY27E: Revenue: 1%/1%; EBITDA: 3%/1%; PAT: 3%3/%

Recommendation Rationale

* Robust Order Book to Drive Growth: The company has an order book of Rs 18,057 Cr (as of 30 th September, 2025) and a YTD order inflow of Rs 4,374 Cr. The order book is primarily composed of Hospital at 9% (Rs 1,619 Cr), Commercial at 20.6% (Rs 3,711 Cr), Institutional at 3.7% (Rs 661 Cr), Residential at 43.8% (Rs 7,918 Cr), Infrastructure at 22% (Rs 3,997 Cr), and Hotel at 0.7% (Rs 150 Cr). By geography, East constitutes 15%, North 50%, West 30%, South 4%, and Overseas 1%. The robust order book provides revenue visibility for the next 2– 2.5 years. Hence, ACIL is expected to deliver a strong revenue growth of 19% CAGR over FY25–FY27E and is likely to post improved margins with better execution.

* Strong Order Inflow: The company reported YTD order inflows of Rs 4,374 Cr and holds L1 status in 2 projects worth Rs 1,620 Cr. For FY26, management has guided for order inflows of over Rs 8,000 Cr. The bidding pipeline stood at Rs 6,000 Cr for the private segment. It aims to keep 50–60% of its order book weighted toward private sector projects, reflecting its strategic focus on private capex, where it sees stronger visibility and more scalable opportunities.

* Improvement in EBITDA Margins: During Q2FY26, the company reported a sharp improvement in EBITDA margins to 10.9% from 7.3% in the previous year on the back of better execution. With a large executable order book and better operating conditions in H2FY26, margins are expected to sustain, especially with the pickup of the CST project in Mumbai and other large projects. Double-digit margins are expected from H2FY26. We forecast EBITDA and PAT to grow at a 35% and 34% CAGR, respectively, over FY25–27E.

Sector Outlook: Positive

Company Outlook & Guidance: For FY26, revenue growth of 15-20% is expected with doubledigit EBITDA margins

Current Valuation: 20x FY27E EPS (Earlier Valuation: 20x FY27E EPS).

Current TP: Rs 1,085/share (Earlier TP: Rs 1,050/share)

Recommendation: We maintain our BUY rating on the stock

Financial Performance

Ahluwalia Contracts India Ltd. (ACIL) reported a strong set of Q2FY26 numbers. The company reported revenue of Rs 1,177 Cr (up 16% YoY) and EBITDA of Rs 129 Cr ( up 75% YoY). It posted a PAT of Rs 79 Cr, up 106% YoY, driven by a large executable order book and better execution. EBITDA margins stood at 10.9% in Q2FY26 (our estimate: 8.8%) compared to 7.3% in Q2FY25.

Outlook: Given its large executable order book and favourable attributes—including a strong and diversified order book, a healthy bidding pipeline, steady order inflows, an asset-light operating model, and emerging opportunities in the construction space—ACIL is well-positioned to generate healthy cash flows and is expected to deliver revenue/EBITDA/PAT growth of 19%/35%/34% CAGR over FY25–FY27E

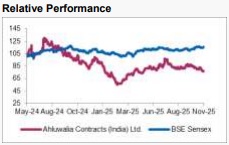

Valuation & Recommendation: The stock is currently trading at 21x/18x FY26E/FY27E EPS. We maintain our BUY rating on the stock, valuing the company at 20x FY27E EPS, with a TP of Rs 1,085/share, which implies a 10% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633