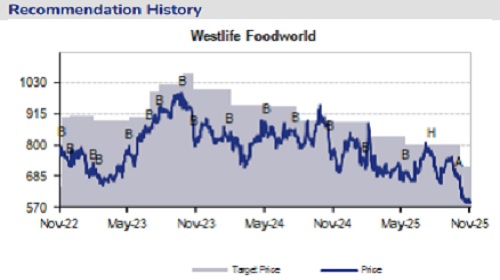

Add Westlife Foodworld Ltd For Target Rs. 650 By JM Financial Services

Revenue growth remained subdued at 4% YoY (4% miss) in 2QFY26 as SSSG declined 2.8% YoY. Pressure on AUV continues (declined 3% YoY). The management highlighted that operating environment was decent in July and Aug, while there were challenges in Sep in terms of demand. The Bengaluru region specifically dragged the company’s performance. October, however, registered substantial improvement over September. Out-of-home consumption for the entire eating out industry registered 4-5% decline in Aug-Sep in its region, with higher decline for western fast food. The management is confident of maintaining market share in its region. Restaurant operating margin expanded largely due to higher gross margin (GM) led by better supply chain efficiency and lower delivery saliency. EBITDA margin, however, declined due to front-loading of costs for multiple new initiatives towards revamping its own delivery app and for tech-based store additions system. The management estimates incremental SSSG of 3-5% and cash flows of INR 400mn-500mn to be generated over the next in 1.5-2 years. It is confident of achieving its vision 2027 guidance towards store opening and EBITDA margin. Focus will be on driving sustainable profitable growth through value offerings and product innovations. Delay in demand recovery is resulting in operating deleverage and weak operating margins. Owing to this, we cut our Pre-Ind AS EBITDA estimates by 15-30% for FY26-28 and maintain ADD rating on the stock with a revised target price of INR 650 (INR 720 earlier) based on 27x EV/EBITDA (Pre Ind AS-116) despite roll forward of multiple to Sep-27.

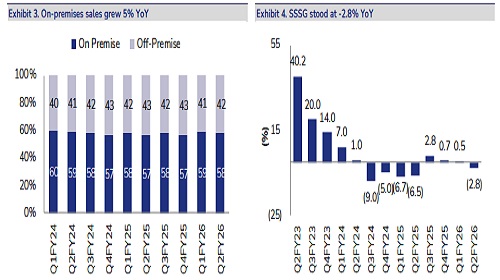

* Weak performance; miss vs. our estimates: Net revenue grew ~4% YoY to ~INR 6.4 bn (5% below JMFe). SSSG declined 2.8% YoY. AUV/ store fell ~3% YoY to INR 59.1mn. Restaurant EBITDA grew 8% YoY to INR 1.2bn (~8% below JMFe) as margin expanded ~70bps YoY to 19.2% (JMFe: 19.8%) led by ~270bps YoY GM expansion to 72.4% (JMFe: 71.2%) on the back of by supply chain efficiencies, partially offset by ~200bps/ 160bps higher occupancy/G&A expense. EBITDA declined 4% YoY to INR 756mn (16% below JMFe) partially offset by cost optimisation initiatives. EBITDA (Pre-AS 116) declined 16% YoY to INR 395mn (margin: 6.2%). PBT loss stood at INR 87mn as interest and depreciation expense grew 15%/14% YoY, partially offset by 39% higher other income. Adj PAT loss stood at INR 66mn (JMFe: profit of INR 44mn), while Reported PAT was INR 275 mn. Exceptional item include assets written off pertaining to restaurants relocation/closure and income from sale of assets totalling up to gain of INR 341mn (adjusting tax).

* On-premises business grew 5% YoY, off-premises flat; 6 stores (net) added in 2Q: Onpremises sales grew by 5% YoY, while off-premises sales were largely flat, with the latter’s contribution contracting by ~100bps YoY to 42% of total sales in 2QFY26. The company added 8 new stores and closed 2 stores in 2Q (total - 450 stores across 72 cities). It operates 108 drive-throughs, which constitute ~24% of total restaurants. It added 19 McCafes (total – 436). It is on track to reach its target of 580-630 stores and achieve operating EBITDA margin of 18- 20% (Post-Ind AS) led by operating efficiency as per its Vision 2027. Hrushit Shah (CFO) has resigned owing to personal reasons.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)