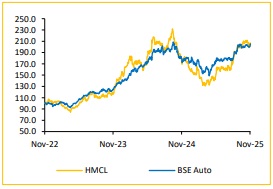

Add Hero MotoCorp Ltd. for Target Rs. 5,710 By Choice Broking Ltd

Sustained Outperformance Supported by Structural Tailwinds: HMCL delivered its highest-ever quarterly performance in Q2FY26, supported by a timely GST cut which significantly enhanced affordability and strengthened consumer sentiment. The company continues to demonstrate strong margin resilience, with ICE segment EBITDA expanding 121 bps YoY to 17.7% despite INR 2,520 Mn of EV investments, driven by cost-efficiency under the LEAP program and an improving mix profile. With the GST-led demand tailwind and improving rural sentiment, we expect the momentum to sustain into H2FY26E, aiding further market share gain across core and emerging segments.

Strengthening Core Portfolio and EV Evolution: HMCL is effectively leveraging the GST cut to revive the crucial 100cc entry segment, gaining 5% share in H1FY26, supported by successful launches, such as HF Deluxe Pro and continued Splendor dominance. We believe the sharp rise in first-time buyers (81% of festive sales) reflects meaningful customer expansion in the mobility ecosystem. In scooters, recent models (Destini 125, Zoom 125) have helped the company secure ~10% share in the 125cc category. We expect ‘scooterisation’ to remain a structural growth driver, aided by portfolio subsegmentation and upcoming new models. Meanwhile, the Vida EV portfolio continues to scale up rapidly, achieving a record 11.7% market share. The VIDA VX2 remains the key growth engine, aided by the Battery-as-a-Service model which reduces upfront ownership costs. With improving BOM costs, PLI benefits and the recent price hike, we expect EV contribution margins to steadily improve as volumes ramp up

View and Valuation: We revise our FY26/27E EPS estimate upwards by 1.1%/0.6% and arrive at our target price of INR 5,710. We value the company at 18x (earlier, 17x), on the average of FY27/28E EPS. Hence, we change our rating from ‘REDUCE’ to ‘ADD’, considering better growth momentum for entry-level segment.

Revenue, PAT in line; EBITDA margin better than estimate

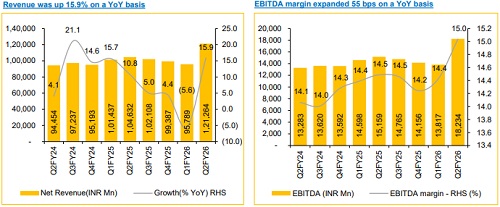

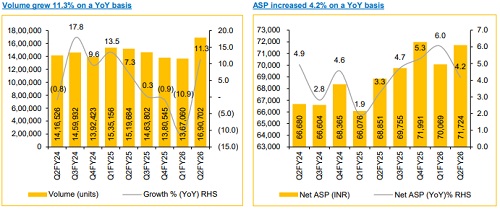

* Revenue was up 15.9% YoY and up 26.6% QoQ to INR 1,21,264 Mn (vs CIE est. at INR 1,18,466 Mn) led by 11.3% YoY growth in volume and 4.2% YoY growth in ASP.

* EBITDA was up 20.3% YoY and up 32.0% QoQ to INR 18,234 Mn (vs CIE est. at INR 17,178 Mn). EBITDA margin was up 55 bps YoY and up 61 bps QoQ to 15.0% (vs CIE est. at 14.5%).

* PAT was up 15.7% YoY and up 23.7% QoQ to INR 13,928 Mn (vs CIE est. at INR 13,796 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131