Economic Pathway-December 2025 by CareEdge Ratings

Economic Growth Momentum

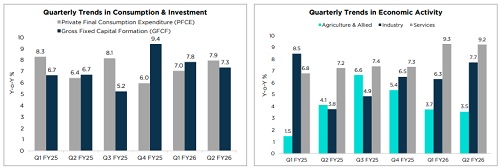

GDP Growth Accelerated to a Six-Quarter High in Q2 FY26

* Early festive season demand, income tax cuts, GST rate rationalisation, easing inflation and export front-loading supported the better-than-expected growth print.

* Low base of last year, and low deflator in this period were statistical factors, that pushed up the growth numbers in Q2.

* Looking ahead, we expect the GDP growth to moderate to ~7% in H2 from an average of 8% in H1.

* We estimate the economy to grow by 7.5% in FY26 and 7% in FY27.

Economic Growth Momentum

Underlying Factors Driving the GDP Growth Momentum

* Income tax cuts, GST rationalisation, early festive season and easing inflation supported the acceleration in PFCE (consumption) to 7.9% in Q2.

* Industrial growth witnessed a sharp uptick in Q2, led by the manufacturing sector, which recorded growth of 9.1% compared to 7.7% growth in Q1.

* GDP growth momentum is expected to moderate in H2 FY26, as the support from export front-loading, the festive season-led consumption boost, and the low base wanes

Economic Activity

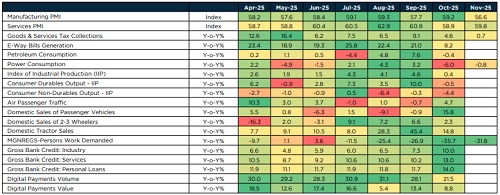

Performance in High Frequency Indicators

* India’s manufacturing PMI eased in Nov as new export orders moderated to a 13-month low and business confidence moderated amid the ongoing tariff concerns.

* GST growth moderated in Nov, reflecting the impact of the GST rate rationalisation. IIP growth weakened in Oct, partly due to fewer working days due to multiple festivals.

* Meanwhile, other indicators such as bank credit growth accelerated in Oct; Auto sales, digital payments continued to hold up well.

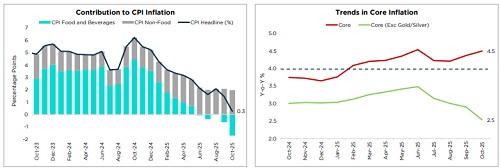

Inflationary Scenario

India’s CPI Inflation Eased to an All-Time Low in October

* CPI inflation eased to an all-time low of 0.3% in Oct, aided by the positive impact of the GST rationalisation and deflation in the food and beverages category.

* Core CPI rose to 4.4%, amid double-digit inflation seen in precious metals. Excluding the precious metals, core CPI inflation was benign at 2.5%.

* Inflation has likely bottomed out in Oct, but we estimate it remains benign, averaging 0.9% in Q3, before rising to an average of 3.1% in Q4 FY26.

* We project an average inflation rate of 2.1% for FY26 and 4% in FY27.

* Taking comfort from very low inflation, the RBI has slashed the policy repo rate by 25 bps to further stimulate the growth momentum

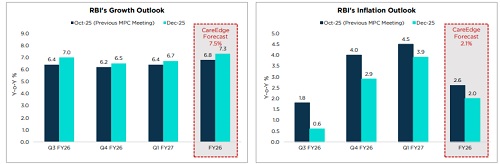

RBI Outlook of Growth & Inflation

RBI Upgrades GDP Forecast & Lowers Inflation Forecast for FY26

* RBI lifted its FY26 GDP growth forecast by 50 bps to 7.3% following the economy’s upbeat growth performance in H1.

* Amid sustained easing in inflation and favourable food price outlook, the RBI has revised its full-year inflation forecast to 2% from the earlier forecast of 2.6%.

* We maintain our growth and inflation forecast at 7.5% and 2.1%, respectively for FY26.

Above views are of the author and not of the website kindly read disclaimer