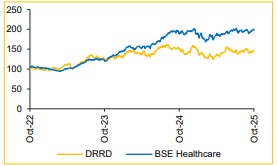

Add Dr Reddy`s Laboratories Ltd for the Target Rs. 1,380 by Choice Institutional Equities

Pipeline Execution and Ex-US Growth to Support Margin Recovery

DRRD is set to strengthen its pipeline with key launches in GLP-1, biosimilars and generics, which we expect to offset the Revlimid impact on EBITDA margin. Execution and scale-up will remain critical, with ex-US markets projected to grow in double digits. We expect margin returning to ~25% by FY27E, supported by cost-optimisation, strategic acquisitions and partnerships

We have revised FY27E estimates up by 4.9% and continue to value the stock at 15x the average of FY27–28 EPS. This results in a revised TP of INR 1,380 (Q1FY26: INR 1,270) and an upgraded ADD rating.

Results Below Estimates, Margin Pressure Weighs on Performance

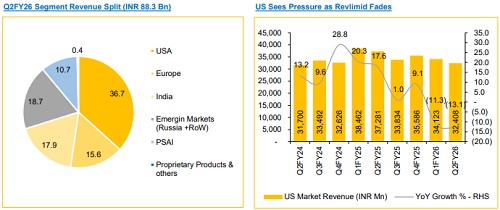

* Revenue grew 9.8% YoY / 3.0% QoQ to INR 88.3 Bn (vs. CIE estimate: INR 92.3 Bn).

* EBITDA declined 3.2% YoY / 7.5% QoQ to INR 20.1 Bn (vs. CIE estimate: INR 23.7 Bn); margin contracted 307 bps YoY / 259 bps QoQ to 22.8% (vs. CIE estimate: 25.7%).

* PAT increased 7.3% YoY but declined 5.0% QoQ to INR 13.5 Bn (vs. CIE estimate: INR 16.1 Bn).

Ex-US Markets Set for Sustained Double-Digit Growth in FY26E

DRRD continued to post strong growth in ex-US markets (India, Europe, EM) and we expect this trend to sustain with double-digit momentum in FY26E. In India, growth will be driven by new launches, such as Tegoprazan and Linaclotide, alongside inorganic additions, such as Stugeron (anti-vertigo, CNS). In Europe, new launches in injectables and complex generics will drive growth, while EM growth is supported by rising oncology biosimilar demand coupled with local partnerships across Russia, LATAM, ASEAN and MEA.

Pipeline Execution Key for Margin Expansion, Expecting 25.5% by FY27E

DRRD’s EBITDA margin contracted sharply by 307bps YoY, primarily due to lower Revlimid sales and reduced operating leverage in the PSAI business. Management, however, remains confident of returning to historical levels (~25%), but we believe successful pipeline execution will be critical. We expect margin expansion to be driven by biosimilar scale-up, effective launch and commercialisation of GLP-1, cost-optimisation and business development initiatives, projecting EBITDA margin to reach 25.5% by FY27E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131