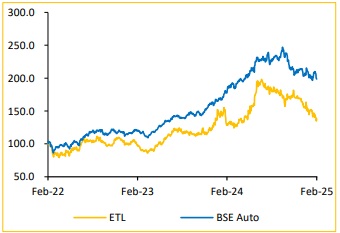

Hold Endurance Technologies Ltd For the Target Rs. 1,980 by Choice Broking Ltd

ENDU Q3FY25 Revenue & EBITDA Slightly Below Estimates, PAT Misses Expectations

* Revenue for Q3FY25 was at INR 28,592Mn up 11.6% YoY and down 1.8% QoQ (vs Consensus est. at INR 29,049Mn).

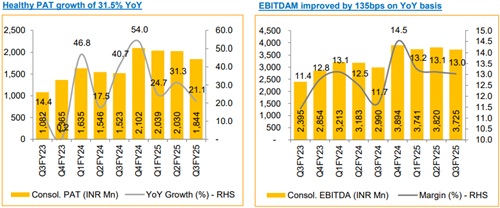

* EBITDA for Q3FY25 was reported at INR 3,725Mn, (vs Consensus est. INR 3,826Mn), up 24.6% YoY and down 2.5% QoQ. EBITDA margin improved on YoY basis by 135bps at 13.0% but were 9bps down QoQ.

* PAT for Q3FY25 reported at INR 1,844Mn, (vs Consensus est. INR 1,975Mn), up 21.5% YoY and down 9.2% QoQ

Strategic Expansion in Germany Through Stoferle Acquisition:

ENDU has invested EUR 160Mn in the last five years in acquiring Stoferle, strengthening its position in the German transmission components market by expanding its OEM customer base and increasing sole supplier status to 80% of its product range. With an annual revenue of EUR 80Mn and an EBITDA margin of 18-20%, Stoferle operates on a cash-free, debt-free basis, ensuring financial efficiency and an early payback. The deal, signed on December 12th and pending antitrust approval, brings operational synergies by leveraging Stoferle’s in-house machine production expertise to enhance automation and optimize capacity utilization.

Robust Order Pipeline and Expanding Four-Wheeler Focus:

* ENDU has secured INR 7,806Mn in new orders this financial year, excluding Bajaj Auto, with four-wheelers contributing 40% of total wins.

* Close to INR 14,000Mn of new orders won since FY21 are expected to have their SOP by the end of this financial year, with an additional INR 10,000Mn in FY26.

* The company is actively pursuing INR 32,000Mn in RFQs, from various OEM customers other than Bajaj, including a strong pipeline for electric four-wheelers.

* The company secured an export order worth INR 1,500Mn from a leading premium and EV segment OEM.

* European operations further strengthen global growth with EUR 12.4Mn in hybrid segment orders from Volkswagen and BMW.

View and Valuation:

We expect the company to deliver steady growth, supported by capacity expansion and new order wins across segments. While European operations continue to perform well, strong order inflows are offset by a weak demand environment. Given these mixed factors, we revise our FY26/FY27 EPS estimates by -15.1%/-21.2%, and roll forward forecasts, setting a revised target price of INR 1,980 (25x FY27E EPS), while changing our rating from ‘BUY’ to ‘HOLD’.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131