Hold Apcotex Industries Ltd For Target Rs.415 by Axis Securities Ltd

Volume Growth Continues but Valuation Remains Stretched; Downgrade to HOLD

Est. Vs. Actual for Q1FY26: Revenue: INLINE; EBITDA: MISS; PAT: INLINE

Change in Estimates post Q1FY26

FY26E/FY27E: Revenue: 4%/3%; EBITDA: 4%/3%; PAT: 6%/9%

Recommendation Rationale

* Continued Strong Volume Growth: The company posted a solid 25% YoY increase in volumes during the quarter, marking the sixth consecutive quarter of volume growth since Q4FY24, which contributed to revenue of Rs 376 Cr. Higher capacity utilisation and increased volumes translated into a 22% YoY rise in EBITDA, highlighting improved operating leverage and cost efficiencies. EBITDA margin expanded to 10% (vs. 9.4% in Q1FY25), supported by a favourable product mix, higher sales volumes, and lower raw material costs on a YoY basis.

* Steady Growth in Export: Export revenues rose 37% YoY, maintaining the company's strong export momentum, with exports contributing 37% to total sales. Growth was driven by new approvals, market share gains, and the introduction of new products targeting speciality and construction applications. Management expects export contribution to increase further, reaching around 40–43% of total revenue in the coming year.

* Capacity Expansion: The company is evaluating expansion opportunities across its existing product portfolio, including NBR, Styrene Butadiene Latex, and Styrene Acrylics Latex. While a comprehensive capex plan is expected to be disclosed after the board approval, management has indicated that certain debottlenecking and brownfield expansion initiatives are under consideration and may be announced once finalised.

Sector Outlook: Neutral

Outlook & Guidance: The company reported strong volume performance for the quarter and anticipates a further increase in capacity utilisation in the coming periods, supported by a rising share of exports. Management noted that existing capacity could reach its limit over the next one and a half years, with a decision on expansion expected in the upcoming quarters. Going forward, the focus will remain on improving profitability through operational efficiencies as utilisation ramps up, while maintaining a cautious stance given ongoing uncertainties surrounding US tariffs.

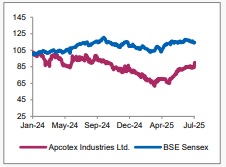

Relative Performance

Current Valuation: 15x FY27E (Unchanged)

Current TP: Rs 415 (Previous TP: Rs 380)

Recommendation: We downgrade our rating from BUY to HOLD on the stock.

Financial Performance

The company reported revenue of Rs 376 Cr, up 12% YoY and 8% QoQ, in line with our estimates. EBITDA stood at Rs 39 Cr, reflecting a growth of 22% YoY but flat QoQ, missing our estimates of Rs 41 Cr. EBITDA margins stood at 10.3%, improving 84 bps YoY but declining 73 bps QoQ. PAT came in at Rs 19 Cr, marking an increase of 29% YoY and 14% QoQ, in line with our estimates.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633