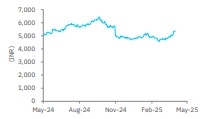

Reduce Britannia Industries Ltd For Target Rs. 5,710 By Elara Capital

Upside capped despite earnings uptick

Britannia Industries (BRIT IN) is set to deliver double-digit earnings growth during FY25– 28E, driven by pricing-led, high single-digit revenue growth and margin gains as inflation eases. In the near term, the company remains focused on volume share and profitability. However, after a 14% stock rally in the past three months, upside appears limited. Therefore, we downgrade to Reduce and raise our TP to INR 5,710 based on a 50x FY27E P/E.

Sequential improvement in sales growth supported by pricing: BRIT reported sales growth of 8.9% YoY to INR 44.3bn in Q4FY25, in line with our expectations, led by 3.5% volume growth. Management said a sequential recovery in demand during Q4, with expectations of a continued gradual improvement into FY26. Market share remains stable in Q4, indicating no loss of competitive positioning. The company continues to strengthen its distribution footprint, expanding direct reach to ~2.9mn outlets vs ~2.8mn in FY24, with current total reach at 6.5mn outlets. Rural distribution also saw an uptick, with 31k distributors compared to 30k in FY24. eCommerce, contributing 4% to overall sales, outpaced other channels with 7.4x growth. Adjacent categories of croissants, rusks, and beverages delivered robust performance, driven by product innovation and enhanced distribution.

Likely improved performance in FY26: Amid a challenging inflationary environment, BRIT continued with calibrated price hikes in Q4, resulting in a 5.5% delta between volume and value growth. Some price actions, undertaken in end-Q4, will be reflected more fully in Q1. While no further pricing interventions are planned, management expects a moderate, temporary impact on volume, which is usual in inflationary cycles. Nonetheless, the company remains confident of delivering double-digit revenue growth in FY26, supported by pricing and a gradual volume rebound. Its new route-to-market (RTM) initiative aimed at improving throughput in high growth urban outlets has yielded encouraging early results. Simultaneously, BRIT is strengthening its innovation pipeline to better align with regional tastes and accelerate premiumization. In its adjacent segments, the relaunch of its cake and cheese portfolio, featuring refreshed packaging and improved recipes, also has seen a strong initial response.

Focus on sustaining margin: EBITDA margin stood at 18.2% for Q4, above our estimates of 16.2%, but down 20bp QoQ. Price hikes helped offset higher input cost, with wheat flour, palm oil, and milk rising 9% QoQ, 7% QoQ, and 11% QoQ, respectively. BRIT will continue to monitor commodity trends and competitive pricing and is ready to act on pricing, if needed. The company aims to sustain current margin while remaining competitive.

Downgrade to Reduce with a higher TP of INR 5,710: We raise our earnings by 2% for FY26E and 4% for FY27E to factor in higher revenue due to pricing and better-than-expected margin. We downgrade to Reduce from Accumulate, given 14% rally in the stock in the past three months. We raise our TP to INR 5,710 from INR 5,200 on 50x (from 48x) FY27E P/E, due to an improved outlook

Please refer disclaimer at Report

SEBI Registration number is INH000000933