Accumulate Tata Steel Ltd for the Target Rs. 196 By Prabhudas Liladhar Capital Ltd

Stellar TSI/TSN; UK remains a drag

Quick Pointers:

* Cost efficiency program delivered savings of Rs54.5bn in H1.

* TSUK breakeven may slip beyond Q4FY26 on worsening UK market conditions led by import-led price pressure.

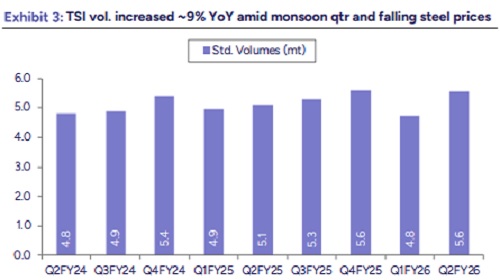

Tata Steel (TATA) reported robust operating performance in Q2FY26 aided by India (TSI) and Netherlands (TSN). TSI EBITDA grew 31% YoY despite 4% QoQ decline in blended realisation amid falling steel prices. TSI volumes grew 9% YoY while leaner coal mix and cost efficiency measures delivered EBITDA/t of Rs14,681 (PLe Rs14,123). TSE delivered flattish sequential operating performance supported by Netherlands while UK (TSUK) losses widened on weak pricing. Going forward, weak pricing in domestic market will get negated by incremental volumes from KPO-II. TSN would be impacted by weak pricing while UK market has worsened due to rising imports which may delay TSUK breakeven. Tailwinds from structural cost transformation initiatives undertaken are evident (Rs55bn in H1) and expected to continue.

Key variables to watch out for: a) notification on safeguard duty, b) EC and commencement of NINL expansion, c) ramping up of KPO-II & Ludhiana EAF, d) development on CBAM & TSUK breakeven. We expect EBITDA CAGR of 23% over FY25-28E on the back of KPO volume ramp-up, expected recovery in domestic pricing and TSE turnaround. At CMP, the stock is trading at 6.5x/5.8x EV of FY27/28E EBITDA. We maintain ‘Accumulate’ rating with TP of Rs196 valuing at 7x EV of Sep’27E TSI EBITDA

* Strong volumes and cost optimisation efforts offset pricing pressure: TSI sales volume increased 8.6% YoY to 5.55mt (17% QoQ; PLe 5.6mt) amid monsoon quarter and falling steel prices. Avg. realisation decreased 4.3% QoQ at Rs62,486/t (-1.4% YoY; PLe Rs63,335/t) on continuous decline in steel prices since June’25. Revenue increased 7% YoY to Rs347bn. Export volumes grew 39% YoY to 0.32mt on weak base (-13% QoQ; ~6% of volumes). In domestic, retail and engineering goods segment grew 13% YoY while infra grew 8% YoY. Auto remained flat YoY at 1.2mt. Continuous Galvanising Line at KPO-II (CGL #1) has received facility approval for supplies to Automotive OEMs. RM costs declined 3% YoY but inched up QoQ mostly due to rising coking coal prices. Other expenses increased 7% YoY mostly on higher repair & maintenance cost and increase in power & fuel costs

* TSN drives recovery at TSE; TSUK losses widen: TSUK EBITDA loss increased QoQ to GBP115/t (-68 in Q1) on lower purchase of substrate offset by lower sales. Volumes declined 5% QoQ to 0.57mt while NSR was down 1% QoQ to GBP883/t. Other expenses increased 10% QoQ due to annual maintenance activity leading to higher repairs & maintenance related expenses. Tata Steel Netherlands (TSN) sales volumes grew 3% QoQ to 1.54mt on ramp up of BF while NSR was up 2% QoQ to GBP867/t. TSN EBITDA/t improved to GBP 51/t from GBP36/t QoQ on lower employee costs and decline in RM costs.

.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)