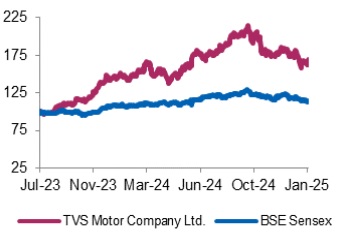

Buy TVS Motor Company Ltd For Target Rs.2,650 by Axis Securities

Rural Revival & Expanding Global Footprint to Accelerate Growth

Est. Vs. Actual for Q3FY25: Revenue – INLINE; EBITDA – INLINE; PAT – Largely INLINE

Change in Estimates post Q3FY25

FY25E/FY26E: Revenue: -0.9%/-0.9%; EBITDA: -0.1%/-0.4%; PAT: -2.6%/-1%

Recommendation Rationale

• Robust Demand Momentum: In Q3FY25, TVS Motor Co Ltd (TVS) saw two-wheeler (2W) volumes grow by ~11% YoY, outperforming the industry’s ~7% YoY growth (2W exports up 26% YoY). We anticipate TVS's total volumes to rise by 13% YoY in FY25E, driven by a recovery in rural demand and an expanded international presence in regions like the Middle East, LATAM, and ASEAN.

• EV Strategy: In Q3FY25, sales of the TVS iQUBE electric two-wheeler (e2W) grew by 57% YoY, increasing from 48k units to 76k units. Management highlighted that the TVS iQUBE is now available at over 900 dealerships across India, with exports beginning in Asian markets. Although all 2W (iQube) models qualify for the PLI scheme, the company has yet to recognise PLI benefits in its income statement. We expect these benefits to have a cumulative positive impact on the margins.

• EBITDA growth outlook: This improvement was driven by stable commodity prices, operational leverage, and cost reduction initiatives, along with a richer product mix throughout the year, though partially offset by an increase in personnel costs. We estimate EBITDA to grow at a CAGR of 18.2% over FY24E-27E.

Sector Outlook: Positive

Company Outlook & Guidance: The company expects to grow faster than the industry, driven by premium two-wheeler models (Raider, Apache, Ronin, and Jupiter125/110), E-3 wheelers (TVS King), and new product launches in both the EV and ICE portfolios over the next two years. We anticipate total sales volume to grow at an 11% CAGR over FY24E-27E

Current Valuation: 29x P/E on core Mar’ 27 EPS (earlier 31x PE on core Mar’ 27 EPS) and other investments at 1x P/BV and TVS Credit Services at 1.5X P/BV.

Current TP: Rs 2,650/share (earlier Rs 2,890/share)

Recommendation: We maintain our BUY rating on the stock.

Financial Performance: The company’s revenue (inline) grew ~10.3% YoY but was down by 1.4% QoQ, mainly led by 10.1% YoY and -1.3% QoQ growth in volumes, while ASP was flat YoY/QoQ. EBITDA (Inline) was up 17% YoY and flat QoQ, primarily attributable to gross margin expansion and sustained cost reduction efforts throughout the year. Higher personnel costs partly offset this. PAT (Inline) grew by ~4.2% YoY while it was down 6.7% QoQ because of loss on fair valuation of Investments (Rs 41 Cr) in the other income. (The company is expected to accrue PLI benefits in Q4FY25).

Outlook: Being well-placed among listed players, we expect the company’s Revenue/EBITDA/PAT to grow by ~15%/18%/24% CAGR over FY24E-27E. We like TVS because of its engineering and R&D capabilities, strong domestic retail network, export recovery, and increasing sales volumes from premium offerings in developed countries (we estimate Norton's business to be able to generate revenues by FY27)

Valuation & Recommendation: Based on the above fundamental outlook, we expect the company to deliver a strong ROCE ranging between 23%-26% over the next few years. With the domestic competitive intensity expected to increase over the next few quarters in the EV and mid-weight motorcycle category, along with challenges in Exports due to Dollar appreciation, we value the stock at a lower yet sustainable P/E multiple of 29x on Mar’ 27 core EPS (earlier 31x on Mar’ 27 EPS) and other investments at 1x P/BV and TVS Credit Services at 1.5x P/BV on FY24, thereby arriving at a TP of Rs 2,650 (earlier Rs 2,890). The TP implies an upside of 13% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633