The Economy Observer : FOMC Octí25: Fed eases, RBI set to follow by Motilal Oswal Financial Services Ltd

* The Fed cut rates by 25bp to 3.75-4.00%, as expected, and announced it will end Quantitative Tightening (QT) from 1st Dec’25 to ease money-market liquidity pressures. Inflation remains elevated but stable, giving the Fed some room to support a weakening labor market.

* With no new projections or dot plot, markets looked to Chair Powell’s press conference. Powell sounded cautious, stressing that future rate cuts are not guaranteed and will depend on upcoming inflation and jobs data. Powell also pointed to uncertainty caused by the US government data delays and emphasized the need to balance growth and inflation risks.

* Market reaction was muted, as the decision was fully priced in. The US Treasury yields ticked up slightly, and the US dollar strengthened modestly after Powell’s cautious remarks. In India and other EMs, investors took comfort from the global easing backdrop but were mindful that the Fed is signaling a pause rather than a rapid series of further cuts.

* At the same time, the Trump-Xi meeting in South Korea eased trade tensions and raised hopes of partial tariff rollbacks, boosting global risk sentiment and further supporting equities and EM currencies. Meanwhile, the BOJ kept policy unchanged but signaled readiness to normalize gradually, hinting at a possible rate hike in Dec’25.

* The Fed is likely to delay or skip another cut in Dec’25, given Powell’s cautious tone and internal uncertainty. Further action will hinge on clearer data on inflation and labor markets.

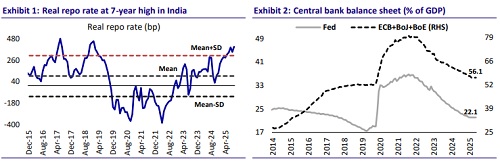

* Implications for India: The Fed’s 25bp rate cut reinforces the global shift toward monetary easing, reducing pressure on EM currencies and encouraging capital inflows into Indian bonds and equities. Softer global yields and improved liquidity conditions are expected to support the rupee and lift overall market sentiment. In India, real interest rates remain high, giving the RBI room to cut rates without risking price stability. Inflation is under control, but growth remains uneven. Further, the pending trade deal with the US continues to weigh on exports and investor confidence. Against this backdrop, the RBI is likely to focus on supporting growth. We expect the RBI to cut rates by 25bp in Dec’25, supported by benign inflation and a favorable global backdrop. A second cut in early 2026 is likely if growth remains below aspirational levels and inflation is contained

* Policy action

1. The FOMC cut the policy rate by 25bp to the 3.75-4.00% range, in line with expectations, while retaining its data-dependent guidance. Inflation remains sticky but stable, giving the Fed space to support a softening labor market. The policy statement noted that inflation remains above target but is trending lower, while labor market conditions have softened modestly with slower job gains and a gradual rise in unemployment.

2. The Fed also announced that it will suspend its quantitative tightening (QT) program and resume full reinvestment of maturing Treasuries beginning 1st Dec’25, to ease money-market liquidity strains.

3. The Fed acknowledged that overall economic activity continues to expand at a moderate pace, but risks to both employment and inflation are now seen as more balanced than earlier in the year.

* Powell’s message

1. In his post-meeting remarks, Chair Powell emphasized that the Fed’s future policy moves will remain data-dependent, cautioning that another cut in December is not guaranteed.

2. He noted that the lack of key economic data due to the US government shutdown leaves the Fed operating with incomplete information and that there are differing views within the FOMC about the need for additional cuts.

* Market Reaction: Muted

1. The market's reaction was largely muted, as the decision was widely priced in. US Treasury yields ticked up slightly, and the dollar strengthened modestly after Powell’s cautious tone. EMs, including India, benefited from the global easing backdrop, with Indian equities gaining and foreign inflows improving on expectations of better liquidity, though investors remained mindful that the Fed is signaling a pause rather than a rapid easing cycle.

2. At the same time, the Trump–Xi meeting in South Korea eased trade tensions and raised hopes of partial tariff rollbacks, while the BOJ held rates steady but signaled readiness to normalize gradually, hinting at a possible December hike to counter a weak yen. These developments together boosted global risk sentiment and supported EM currencies.

* Outlook: Fed unlikely to cut rates in Dec’25

1. The Fed is likely to delay or skip another cut in December, given Powell's cautious tone and internal uncertainty.

2. Further action will hinge on clearer data on inflation and labor markets.

? Implications for India

1. The Fed's 25bp rate cut reinforces the global shift toward monetary easing, giving EMs more room to lower rates without triggering outflows. Softer global yields and improving liquidity conditions could support Indian bonds and reduce pressure on the rupee, allowing the RBI to shift focus toward domestic growth concerns.

2. In India, real interest rates remain high, giving the RBI room to lower policy rates without risking price instability. Inflation is well within target, while growth indicators are mixed. Overall, the outlook remains uncertain, as the pending trade deal with the US continues to weigh on export prospects and investment sentiment.

3. Against this backdrop, the RBI is likely to prioritize growth support through measured rate cuts. We expect the RBI to cut rates by 25bp in Dec'25. A second cut in early 2026 is likely if growth remains below aspirational levels and inflation is contained.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : Understanding monetary transmission - From policy actions to the real...