The Economy Observer : Noví25 IIP: Strong rebound, mfg. leads recovery by Motilal Oswal Financial Services Ltd

Nov’25 IIP: Strong rebound, mfg. leads recovery

* In Nov’25, IIP growth rebounded to 6.7% YoY (vs. 0.5% YoY in Oct’25), led by a broad-based acceleration in the manufacturing sector. Mining output improved sequentially, while electricity output remained a drag.

* IIP performance in Nov’25 was significantly better than expected, indicating a recovery from the seasonal softness seen in Oct’25 (festive holidays, fewer working days) and suggesting that the earlier slowdown was largely transitory.

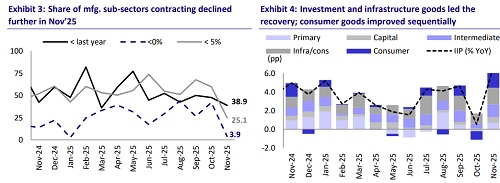

* Manufacturing output grew 8.0% YoY in Nov’25, a sharp acceleration from Oct’25. Manufacturing breadth improved meaningfully, with only ~30% of sub-sectors contracting, indicating a broad-based recovery across industries.

* Among manufacturing segments, 20 out of 23 industry groups recorded an increase in output, with strong growth led by basic metals, motor vehicles & trailers, pharmaceuticals, and machinery, pointing to strength across both consumerlinked and investment-related segments.

* On a use-based classification, the recovery was led by investment and infrastructure-linked goods, reflecting continued government capex support. Consumer goods output improved sequentially, with consumer durables outperforming nondurables, consistent with an urban-led demand recovery, while rural-linked consumption remained relatively subdued.

* Industrial activity is expected to remain range-bound but resilient in the coming months, supported by stable public capex, easing inflation, and improving monetary transmission. However, uneven rural demand and global trade frictions may continue to limit a broad-based acceleration.

Data highlights

* Industrial output growth accelerated sharply to 6.7% YoY in Nov’25 (vs. 0.5% in Oct’25), reflecting a recovery from seasonal distortions and improved manufacturing activity (Exhibit 1). The rebound was led by manufacturing and mining, partially offset by continued weakness in electricity output.

* Manufacturing output grew 8.0% YoY in Nov’25, marking a strong acceleration from Oct’25 (Exhibit 2). Manufacturing breadth improved meaningfully, with ~70% of sub-sectors expanding (Exhibit 3). Among industry groups, 20 out of 23 recorded positive growth, led by basic metals, motor vehicles, pharmaceuticals, and machinery.

* Mining output growth improved to 5.4% YoY in Nov’25, from a 1.8% drop in Oct’25, aided by post-monsoon normalization. This reversal provided incremental support to headline IIP after multiple months of volatility.

* Electricity output remained a drag, contracting 1.5% YoY in Nov’25, following a sharp 6.9% fall in Oct’25. While the pace of contraction moderated, weak power generation continues to cap the upside in industrial growth (Exhibits 1 and 2).

* According to the use-based classification, investment goods and infrastructure/construction goods remained strong, reflecting stable public capex momentum. Consumer goods output improved sequentially, with consumer durables outperforming, while consumer non-durables remained weak, highlighting continued rural demand stress (Exhibit 4).

* The recovery in Nov’25 was broad-based across use-based categories, with a clear tilt toward investment and infrastructure-linked goods. Capital goods output surged to 10.4% YoY in Nov’25, from 2.1% in Oct’25, reinforcing the narrative of steady capex momentum, particularly in government-led and PSUdriven investment activity.

* Infrastructure and construction goods growth strengthened further to 12.1% YoY, up from 7.1% in Oct’25 and 10.6% in Sep’25, indicating continued traction in roads, railways, and urban infrastructure execution (Exhibit 4).

* Consumer goods output rose sharply to 8.5% YoY in Nov’25, reversing a contraction of 3.5% in Oct’25, suggesting normalization after festive-related distortions. Consumer durables grew 10.3% YoY, recovering from a 1.3% fall in Oct’25, consistent with an urban-led discretionary demand recovery. Consumer non-durables rebounded to 7.3% YoY from a 5.2% decline in Oct’25, aided by base effects, though medium-term momentum remains weaker compared to durables, reflecting lingering rural demand stress.

Outlook:

Industrial activity is expected to remain steady to mildly positive in the coming months, supported by robust government capex, benign inflation dynamics, and improving monetary transmission. Investment-driven sectors should continue to provide support, while consumer goods recovery is likely to remain uneven, led by urban demand. Some drag from weak electricity output and global trade uncertainties may persist, but the overall industrial outlook would remain stable.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : All eyes on February: RBI set for another cut? by Motilal Oswal Finan...