The Economy Observer : Rural rules, urban follows by Motilal Oswal Financial Services Ltd

Rural rules, urban follows

We had an opportunity to meet more than 40 investors in the last one month. The key area of interest among investors was the consumption trends in the rural and urban markets after the implementation of GST 2.0. We have composed a proprietary monthly rural and urban consumption tracker to simplify the analysis for our readers.

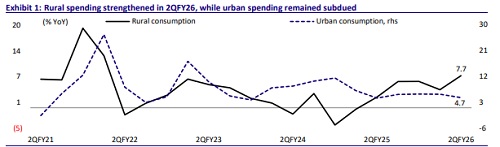

Key Takeaway: We observed that rural consumption continues to outperform urban consumption despite the income tax cuts and GST 2.0 reforms, which are aimed at boosting urban consumption. Undoubtedly, urban consumption has recovered since 22nd Sep’25 and also from 3QFY25; but rural consumption outshines because of income guarantee schemes, better rainfall outcomes, NBFC-led credit growth, easing input costs and steady MSPs.

The October high frequency data is overall positive consumption which is the first full month of GST implementation. Indicators like E-way bills, petrol consumption, mall footfalls, PMI manufacturing/services are strong.

* Our rural demand tracker shows that rural consumption has been on a steady uptrend since 2HFY25, strengthening further in 2QFY26 (up 7.7% YoY) to its highest level in 17 quarters.

* The upturn was supported by firm growth in real agri and non-agri wages, higher tractor and fertilizer sales, and robust farm credit. Better rainfall distribution and reservoir levels boosted sowing activity, while easing input costs and steady MSP procurement helped improve farm incomes.

* The urban demand tracker shows that spending remained subdued in 2QFY26, ahead of the festive season, with several high-frequency indicators showing softer momentum after a stable 1Q. Personal credit growth, petrol demand, and nonfarm imports remained firm in 2QFY26, reflecting resilience in day-to-day discretionary spending, though passenger traffic stayed flat.

* Urban consumption in 3QFY26 is expected to pick up with the GST 2.0 implementation and passthrough of price cuts. Indicators released so far and our channel checks on retail side reflect positive turnaround on urban consumption. However, we also note sector wise variations.

* As per our consumer analyst’ channel check, auto and jewelry sector have performed well; footwear, paints, FMCG and textile sector pickup has been mixed. In the FMCG segment, general trade (GT) feedback has been that demand has not seen much improvement in Oct either, with limited traction in festive-driven products. We do concur that any meaningful growth in alternate channels can create growth divergence for FMCG companies.

* Outlook: As the current wave of pent-up demand subsides with the end of the festive season, the key question is whether this momentum can be sustained into 2HFY26. Our view is that:

* Rural demand is expected to remain on a steady upward trajectory, underpinned by rising real wages (both agri and nonagri). Healthy rabi prospects, coupled with lower rural inflation, should help to sustain the ongoing improvement in consumption.

* Urban consumption remained weak through 2QFY26 but started improving toward late Sep’25, led by a strong rebound in jewelry demand, which stayed firm through Oct’25 despite high gold prices. In contrast, paints and FMCG categories remained soft, impacted by extended monsoons, pricing transitions under GST 2.0, and muted festive traction. With discretionary categories like jewelry gaining momentum and supply disruptions easing, we expect urban spending to revive in 3QFY26.

* Our base case for real GDP growth stands at 6.8% for FY26, with an upside potential (~20-30bp) if tariff-related uncertainties abate. Our nominal GDP growth is projected at 9% for FY26, tempered by a weaker deflator, reflecting subdued price pressures across key sectors.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

India Strategy : Corporate profit-to-GDP: Standing tall at a 17-year high! by Motilal Oswal ...