The Economy Observer : Sep`25 CPI: Lowest in eight years by Motilal Oswal Financial Services Ltd

Sep’25 : Lowest in eight years

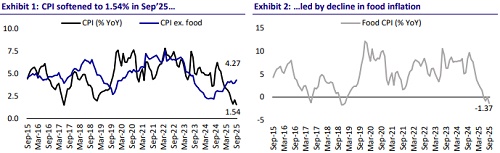

* Headline inflation softened to 1.5% in Sep’25 (lowest since Jun’17) from 2.1% in Aug’25. It remained below the 3% mark for the fifth consecutive month. On a sequential basis, it stood at 0.1% MoM in Sep’25, the lowest in six months.

* The moderation in inflation was led by a decline in food prices, primarily vegetables and pulses. Good kharif harvest, better supplies of vegetables and pulses, and sufficient cereal stock with the FCI resulted in a decline of 1.4% YoY in food prices.

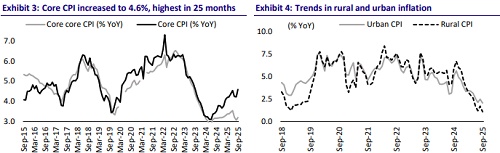

* Core inflation increased to a two-year high of 4.6% in Sep’25, led by an increase in housing inflation and gold and silver prices. Excluding gold and other volatile components like oil, inflation stood at 3.2% in Sep’25, which is well within the RBI’s comfort zone.

* The impact of GST rate cuts is clearly visible in the price decline of motorcars & jeep, motorcycles & scooters, and bicycles. On the other hand, there is limited impact on prices of FMCG products like soaps, oils and shampoos. We believe that the impact of GST rate cuts on prices would be staggered over Oct-Nov’25.

* Rural inflation declined by 60bp to 1.1% YoY in Sep’25, while urban inflation declined by 50bp to 2% YoY.

* In 2QFY26, CPI stood at 1.7% YoY, in line with the RBI’s forecast of 1.8%.

* The RBI has reduced its FY26 inflation forecast to 2.6% (3.1% earlier) in order to account for the GST rate cut impact. The significant moderation in inflation has created additional policy space to support growth. As per the RBI, the adverse impact of tariffs is more than offsetting the positive impact of GST cuts on consumption. This, we believe, provides the rationale to cut rates and further support growth. Against this backdrop, we see a window of a 50bp rate cut opening up in Dec’25/Feb’26.

CPI details

* Food inflation declined, lowest in nearly seven years: Food inflation declined 1.4% in Sep’25 (0.1% MoM), compared to an increase of 0.05% YoY in Aug’25 (0.5% MoM). Food inflation declined in Sep’25 mainly due to improved supply conditions following a strong kharif harvest, especially in vegetables, pulses, and edible oils. The effect of a normal monsoon helped boost crop output and ease supply bottlenecks, while lower global prices of edible oils and cereals further supported the fall. Additionally, government measures to curb food prices, such as buffer stock releases and export controls, also helped keep inflation in check.

* Core inflation at 4.6%, led by gold and silver prices: Core inflation increased to a 25-month high of 4.6% YoY in Sep’25 vs. 4.2% in Aug’25. The continued acceleration in core inflation since Jan’25 is primarily driven by an increase in gold (47% YoY) and silver (42% YoY) prices. Additionally, housing inflation increased to 4% in Sep’25, highest growth in 25 months. Excluding gold and other volatile components like oil (core-core CPI), inflation stood at 3.2% in Sep'25, which is well within the comfort zone.

* Outlook: In 2QFY26, CPI stood at 1.7% YoY, in line with the RBI’s forecast of 1.8%. The RBI has reduced its FY26 inflation forecast to 2.6% (3.1% earlier) in order to account for the GST rate cut impact. The significant moderation in inflation, along with the expected growth deceleration in 2HFY26, has created additional policy space to support growth. Against this backdrop, we see a window of a 50bp rate cut opening up in Dec’25/Feb’26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : All eyes on February: RBI set for another cut? by Motilal Oswal Finan...