The Economy Observer : RBI goes all guns blazing! by Motilal Oswal Financial Services Ltd

Key takeaways: With a 125bp repo rate cut already done in CY25, we anticipate another 25bp rate cut in Feb’26. The primary reason for this anticipation is the benign inflation trajectory for the next one year. The RBI reduced the FY26 inflation forecast to 2.0% from 2.6% earlier. We see downside risk to this forecast. On growth, the RBI upped its FY26 forecast to 7.3% by 50bp. We believe the central bank would be surprised positively here as well, with 3QFY26 beating the RBI expectation of 7%, due to the festive-driven pickup. While low inflation and high growth do provide a Goldilocks environment, extremely low inflation (sub-2%, as the Governor pointed out) is unhealthy for an economy that aspires to grow by 7% or higher. On the liquidity front, the RBI has surprised the market with a durable liquidity injection of INR1.5t (OMOs: INR1t; FX swap: INR500b) in Dec’25 alone. We anticipate additional announcements of OMOs and FX swaps in Feb’26, especially as depreciation pressure on the USDINR is likely to lead to a drawdown on dollar reserves.

Repo rate at 5.25%; 125bp rate cut in CY25

In a unanimous decision, the MPC cut the repo rate by 25bp to 5.25% in today’s policy, citing rapid disinflation in Q2FY26 (1.7%) and Oct’25 (0.3%). The policy stance was kept neutral.

The MPC noted a sharp easing in headline inflation, driven by unusually benign food prices; in Oct’25, about 80% of the CPI basket recorded inflation below 4%. The committee also pointed out that international commodity prices, barring some metals, are expected to moderate further, which supports the disinflation trend.

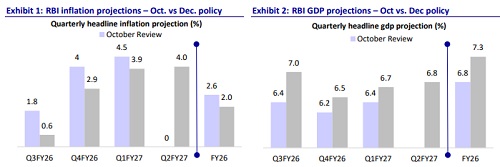

For FY26, CPI inflation is now forecast at 2%, from 2.6% earlier. Excluding the impact of precious metals (which could add roughly 50bp), both core and headline inflation are likely to remain subdued, further strengthening the case for easing. It also cut its quarterly inflation forecasts for 1HFY27 (Exhibit 1).

Given this backdrop of benign food inflation, we expect the final 25bp rate cut of this cycle to come in Feb’26.

External uncertainties weigh on growth outlook

The MPC was optimistic about India’s growth in 1HFY26, pointing to income?tax cuts, GST rationalization, lower oil prices, front?loaded government capex, and favorable monetary and financial conditions as key drivers. However, it also flagged early warning signs – some leading indicators, such as IIP, steel consumption, cement production, electricity demand, and manufacturing PMI, are showing weakness. The MPC noted that external uncertainties remain a downside risk, though swift resolution of pending trade and investment deals could improve the outlook. On this basis, it raised the FY26 GDP growth forecast to 7.3% and also revised up growth expectations for 1HFY27 (Exhibit 2).

Durable liquidity injection to ease rate transmission

On liquidity, the RBI decided to do OMO purchases of INR1tn over two days in Dec’25 of INR500bn each. It also announced 3Y USDINR Buy-Sell swaps of USD5b in Dec’25. This liquidity infusion is above 1% of net demand and time liabilities (NDTL) to facilitate monetary transmission.

We continue to expect further announcements of OMOs and FX swaps in 4QFY26 for durable liquidity injection, at a time when pressure on the rupee is likely to be sustained, and the RBI is likely to intervene to prevent rupee volatility.

10Y G-sec yields to ease towards 6.3% by Mar’26

The 10Y G-Sec yield moved 3-4bp lower post-policy. By March-end, we expect 10Y G-Sec yields to move towards 6.3% levels due to our expectation of another rate cut and easy durable liquidity (close to INR2-INR2.5t).

Rupee to remain rangebound around the 90-91 level

The USDINR rate moved northwards of 90 post-policy, in line with expectations. Unless clarity emerges on trade policy, we continue to expect the rupee to remain range-bound around the 1990-91 level (refer: CAD widens and capital flows weaken).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Low base to push combined capex growth to 13.4% in FY26BE by Motilal Oswal Financial Service...