The Economy Observer : All eyes on February: RBI set for another cut? by Motilal Oswal Financial Services Ltd

All eyes on February: RBI set for another cut?

The RBI is expected to deliver a further 25bp rate cut in February as inflation remains well below target, driven by soft food prices, stable commodity prices, and strong kharif and rabi crop output. Core inflation is also subdued, signaling limited demand-side pressures. MPC members in the December policy minutes highlighted that very low inflation compresses pricing power, may weigh on margins, and could dent investment, reinforcing the need for supportive monetary policy. Meanwhile, high-frequency indicators point to moderation in growth, particularly for MSMEs exposed to trade and tariff uncertainties. The December cut has already eased real rates, and with inflation projected to remain below ~4% in H1FY27, the February easing would provide additional support to consumption and investment without pushing real rates into overly accommodative territory.

* Rate cut with a neutral stance: The RBI delivered a 25bp repo rate cut to 5.25% in Dec’25 while retaining a neutral stance, reflecting confidence in the inflation outlook but caution amid external and trade-related uncertainties.

* Dissent on stance: The rate decision was unanimous, but Prof. Ram Singh voted to shift the stance to accommodative, citing high real rates, a negative output gap, and risks from prolonged low inflation.

* Rationale behind the cut:

* Inflation at record lows: Headline CPI fell below 1% for the second consecutive month in Nov’25, led by a sharp food price correction. Core CPI (ex-precious metals) at ~2.6%, signaling muted demand pressures.

* Growth peaking: HFIs (PMI, IIP, and exports) suggest momentum peaked in H1FY26, with H2 moderation amid tariff and trade uncertainty affecting MSMEs.

* Supply-side comfort: Strong kharif output, healthy rabi sowing, adequate reservoirs, and soft commodity prices anchor inflation expectations.

* Outlook:

* One more cut likely: With inflation well below target and growth moderating, we expect a 25bp cut in February, supporting MSMEs amid trade and tariff pressures. We believe that inflation is likely to remain benign through 1HFY27, providing the MPC adequate space to prioritise growth support.

* Pause thereafter: After February, the MPC may enter an extended pause, as real rates approach the neutral range and FY27 inflation nears ~4%, making further easing data-dependent.

* February policy key: The MPC will review the new GDP and CPI series, which could influence growth, inflation, and terminal rate guidance.

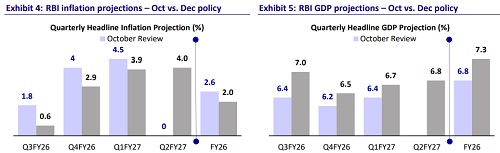

* Growth strong but past its peak: While Q2FY26 growth surprised on the upside at 8.2%, members acknowledged that growth momentum has likely peaked in H1. The MPC expects moderation ahead, with GDP growth projected at 7.3% in FY26 and 6.7–6.8% in H1FY27. High-frequency indicators—PMI, IIP, exports, and business surveys—point to moderation since Oct’25. External headwinds, including trade and tariff-related uncertainty, were flagged as risks, particularly for MSMEs, which account for a large share of employment.

* Inflation outlook dominates policy thinking: The minutes repeatedly emphasize that benign inflation was the primary driver of policy action. CPI inflation is projected to average 2% in FY26 before mounting towards ~4% in FY27. Excluding precious metals, inflation is even lower, suggesting slack and a negative output gap. Some members flagged that very low inflation could hurt margins and investment, but the balance of risks favored growth support.

* Transmission supportive: MPC members observed that the cumulative 100bp of rate cuts over the past year have been transmitted effectively across the financial system. Lending rates have eased noticeably, leading to improved credit offtake, particularly for MSMEs and other growth-sensitive sectors. This has helped bridge the gap between policy intentions and real economy impact, supporting investment and working capital needs. Members highlighted that the smoother transmission underpins the effectiveness of monetary easing, ensuring that the benefits of lower policy rates are reflected in borrowing costs, consumption, and capex decisions across key sectors.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : WPI inflation stood at 2.3% in Jan`25 By Motilal Oswal Financial Serv...