The Economy Observer : India`s services trade surplus reaches a record high of 4.8% of GDP in FY25 by Motilal Oswal Financial Services Ltd

India’s services trade surplus reaches a record high of 4.8% of GDP in FY25

Share of Professional and Management (P&M) consulting has increased nearly 3.7x over the past seven years

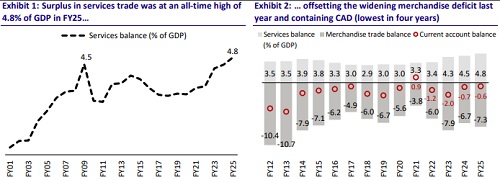

* India's services trade surplus reached a record high of 4.8% of GDP in FY25, marking a steady upward trend over the past few years. The previous peak of 4.5% in FY09 was followed by a period of moderation; however, the surplus began to rise again after FY20. This sharp increase reflects the robust performance of India’s services exports, particularly in IT and business services, and highlights the growing contribution of the services sector to the external sector stability. (Exhibit 1).

* The services trade surplus has played a crucial role in mitigating the impact of a consistently high merchandise trade deficit. During FY22-FY25, the merchandise deficit remained at around 8% of GDP. However, the rise in services surplus helped limit the current account deficit (CAD). In FY25, despite a merchandise deficit of 7.3%, CAD was contained at just 0.6% of GDP—the lowest in four years. This underscores the buffering effect of services exports in maintaining external balance amid rising import bills. (Exhibit 2). In this note, we delve deeper into our services trade and discuss the key drivers of the rising surplus. Our analysis reveals seven key points:

* Computer services remained the dominant contributor to India’s total services receipts, consistently accounting for around 47-49% during FY21-FY25. The travel and transport segments also maintained stable shares, while P&M consulting showed a notable increase from 4% in FY21 to 10% by FY25. Together, the five major segments— computer, transport, travel, P&M consulting, and technical trade—contributed nearly 89% of total receipts in FY25, reflecting a broad-based and resilient services export base. (Exhibit 3).

* On the payments side, the composition is more diversified, with computer services accounting for a smaller but stable share of 8-11%. The travel and transport segments dominated the market, with transport services consistently accounting for over 20% and travel holding steady in the 23-27% range throughout the period. Payments for professional services and technical trade have also seen steady growth, while the share of others has gradually declined. These five segments collectively accounted for roughly 79% of total payments in FY25, indicating sustained outflows in line with growing demand for global service inputs and mobility. (Exhibit 4).

* Computer services remained the largest contributor to the surplus, with its share steadily rising from 2.7% of GDP in FY18 to 4.1% in FY25—nearly 1.5x. (Exhibit 5).

* Over the past seven years, India’s surplus in P&M consulting services has expanded significantly from 0.4% of GDP in FY18 to 1.4% in FY25—increasing nearly 3.7x. This segment has consistently shown positive growth each year, reflecting rising global demand for India's consultancy expertise. (Exhibit 5).

* The share of P&M consulting in India’s total services trade surplus has increased significantly—from just 13% in FY18 to 31% by Q3FY25. This steady rise highlights the growing global competitiveness of Indian consultancy firms, especially in domains such as legal, business, accounting, and engineering advisory. The upward trend reflects increased export capabilities, broader client outreach across geographies, and a shift in global demand toward specialized, skill-intensive services. As a result, P&M consulting has emerged as the second-largest contributor to the overall services surplus, following computer services, reinforcing India’s evolution into a knowledge-driven services hub. (Exhibit 6).

* Travel and transport services have maintained a modest surplus, with a slight upward trend over the years. In contrast, technical and trade-related services, along with the others category, have consistently recorded a deficit, though relatively stable, at around -0.5% to -0.8% of GDP.

* This persistent negative balance in these segments has had a limited drag effect, given the much stronger performance of consulting and computer services. This broader trend highlights a gradual strengthening and diversification of India's services trade surplus, driven primarily by high-value, knowledge-based exports.

Overall, India’s services exports have demonstrated remarkable resilience and structural strength, driven by robust growth in high-value segments like computer services and professional & management consulting. With a recordhigh surplus of 4.8% of GDP in FY25 and a diversified export base, the sector is well-positioned to remain a key pillar of external stability. Over the next five years, continued digital transformation, global outsourcing trends, and rising demand for skilled services are expected to further boost export momentum. As a result, we believe that India’s services exports are likely to see steady growth, potentially driving the trade surplus higher and offsetting pressures from merchandise trade imbalances. Despite India’s strong structural position in services exports, the outlook faces notable risks from a potential global slowdown.

A deceleration in advanced economies—particularly the US and Europe, which are key markets for IT, consulting, and financial services—could dampen demand for outsourced services and reduce discretionary spending on consulting and travel. Tighter global financial conditions may further delay corporate tech budgets and project pipelines, directly impacting high-margin export segments like software services. Additionally, increased protectionism, tightening visa regimes, and evolving global supply chains could create external headwinds. If the slowdown is prolonged, it could contract margins, reduce export growth, and narrow the services trade surplus, partially offsetting gains made in recent years.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : FY27 Budget Preview: Defense-led capex growth by Motilal Oswal Financ...