The Economy Observer : Rural spending likely improved in FY25 by Motilal Oswal Financial Services Ltd

Rural spending likely improved in FY25

Expect real PFCE to grow ~7% from 5.6% in FY24

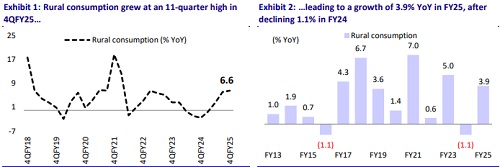

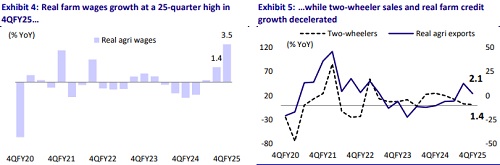

* An analysis of 12 proxy indicators suggests that the rural sector’s spending grew at an 11-quarter high in 4QFY25. Rural spending increased 6.6% YoY in 4QFY25, following a growth of 6.1% YoY in 3QFY25 and a decline of 2.5% in 4QFY24 (Exhibit 1). The acceleration was mainly led by an improvement in real agri wages, which grew at a 25-month high pace in 4QFY25. Additionally, fiscal real rural spending is expected to grow at a six-quarter high in 4QFY25 after contracting for five straight quarters. Additionally, the robust growth in tractor and fertilizer sales outweighed the deceleration in real agri exports growth, the six-quarter lowest growth in two-wheeler sales and the eight-quarter lowest growth in farm terms of trade. Consequently, real rural spending increased 3.9% YoY in FY25 after declining 1.1% in FY24. While real rural spending growth improved to 3.9% in FY25, it is still lower than the 5% growth in FY23.

* Urban consumption—estimated by compiling nine proxy indicators—grew at a four-quarter high pace of 6.2% YoY in 4QFY25 (vs. 6.1%/10.2% in 3QFY25/4QFY24). Urban consumption growth had decelerated to a six-quarter low of 5.2% in 2QFY25. A simple average of the nine indicators used to analyze urban spending trends suggests that urban spending grew at a four-year low pace of 5.8% in FY25, compared to 8.4%/8.6% growth in FY24/FY23. A detailed analysis of the nine indicators used in urban consumption confirms that three indicators—real salaries and wages of BSE500 companies, real personal credit, and real non-farm consumer imports—witnessed a sharp acceleration in growth, while IIP consumer durable goods, petrol consumption, domestic PV sales, and real house prices decelerated in 4QFY25 vs. 3QFY25.

* Rural spending witnessed an improvement in FY25 after contracting 1.1% in FY25, led by an improvement in real rural wages and reservoir levels. At the same time, the urban sector witnessed a deceleration, growing at the four-year lowest pace of 5.8% in FY25, vs. an average growth of 9% in the last three years. The divergence between rural and urban spending has come down in FY25 compared to the preceding three years (FY22-FY24). In the last two quarters of FY25, rural consumption growth outpaced urban consumption—which contrasts with FY22-FY24, when the latter grew faster than the former in each quarter. Although urban spending decelerated to a four-year low of 5.8% in FY25, acceleration in rural spending will likely help recover real Private Final Consumption Expenditure (PFCE) growth in FY25 from its FY24 lows. We expect real private consumption expenditure to grow at ~7% in FY25 vs. 5.6% in FY24.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : 4QCY24 A one-stop guide to the key macro/financial indicators By Moti...