Reduce National Aluminium Co Ltd For Target Rs. 302 By InCred Equities

Downgrade to REDUCE

* Aluminium risk is rising: Scrap-driven supply growth could push aluminium prices lower, hurting producers like National Aluminium Company (NALCO).

* Alumina outlook weak: NALCO’s expansion comes in as alumina prices soften and linkage to aluminium weakens.

* Downgrade due to earnings risk: EBITDA may decline; stock downgraded to REDUCE rating with a new TP of Rs302. Aluminium prices are a key risk.

Peak aluminium prices don’t bode well for its Indian operations Aluminium’s rally appears largely macro-driven particularly by expectations of a weaker US dollar rather than tight fundamentals. Current prices keep most primary smelters globally viable, limiting supply discipline. Meanwhile, higher prices are boosting scrap collection, with the primary-over-scrap spread at +2SD above long-term average, typically triggering a strong recycling response. The global used-aluminium pool is 1.4bnt (billion tonne), as per data from the International Aluminium Institute (IAI), and scrappage rates can rise from the historical 1.4-1.5% to 1.7% during high-incentive periods. As macroeconomic support fades and scrap supply improves, we expect aluminium prices to decline by 20% over the next one year, which would negatively impact NALCO, given the company’s sensitivity to London Metal Exchange (LME) prices.

Alumina expansion coming in at a time when prices are falling National Aluminium Company, or NALCO’s alumina expansion project is getting commissioned at a time when its prices are falling and as the incremental metal supply is most likely to come from scrap sources, the future demand trajectory for alumina will remain under question. Historically, alumina has traded around 16-17% of aluminium prices; however, in the recent past it has fallen to as low as 10%, indicating that alumina prices have somewhat delinked from aluminium prices.

EBITDA to decline to Rs61.7bn in FY28F from Rs72.6bn in FY26F The dip in aluminium prices will hit NALCO hard; however, a part of the impact can be offset by rising alumina volume. Having said that, in a world where the primary source of incremental pure metal is scrap rather than smelted metal, the question is how long aluminium can sustain at a price of US$325/t. We have built in US$325/t alumina price, which is 13% of the pure metal price in FY27F (our aluminium price for FY27F is US$2,500/t). Hence, we are assuming alumina, which is often sold as a percentage of pure metal, will rise from 10% in FY26F to 13% in FY27F. In that sense, our assumption is aggressive

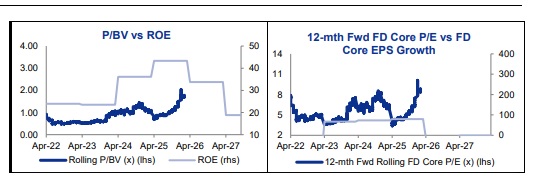

Downgrade NALCO to REDUCE with a new target price of Rs302 NALCO is trading at a significant premium valuation of 4× P/BV; however, given the upcycle, on an EV/EBITDA basis, the stock is still near its historical average. We continue to believe that P/BV is the right metric to evaluate the company; however, to account for the upcoming expansion, we value it at 7.5× FY28F EV/EBITDA to arrive at a new target price of Rs302 (Rs176 earlier). Upside risk: Sustained firmness in aluminium prices.

Above views are of the author and not of the website kindly read disclaimer