Buy Vishal Mega Mart Ltd For Target Rs. 140 By Elara Capital Ltd

Strong performance

Vishal Mega Mart’s (VMM IN) Q3 performance remained robust in terms of revenue and PAT, while EBITDA margins were hit by higher employee cost led by ESOP charges in Q3 and other expenses. VMM is on track to open new stores and its mix is healthy (in favor of apparel). We maintain our positive stance based on VMM’s long-term growth trajectory considering aggressive store openings, strong category mix and high share of private labels. We maintain BUY with TP maintained at INR 140, on 66x FY27E P/E.

Revenue up 19.5% YoY, led by strong SSSG:

In Q3, VMM reported a 19.5% YoY revenue growth, led by new store openings and same store sales growth (SSSG) of 10.5%. SSSG was led by strong product portfolio and private label contribution. Apparel contributed ~46%, FMCG ~26% and general merchandise ~28% to revenues. Due to festival and wedding seasons, apparel contribution was strong. Expect revenue mix to largely be in similar range in the medium term. Expect revenue CAGR of 19.2% in FY24-27E.

EBITDA margin hit by higher costs:

Gross margin expanded by 55bps to 29.1%, led by favorable revenue mix. Q3 EBIDTA margin declined 17bps YoY to 16.1%, hit by higher employee costs (driven by increased ESOP charges) and other expenses (mainly from higher warehousing costs, which should normalize in Q4.) PAT grew 27.9% YoY to INR 2,627mn, led by slower increase in depreciation, decline in interest cost and 86.5% YoY rise in other income. Adjusted EBITDA (pre-IndAS and pre-ESOP charges) grew 32.4% YoY to INR 3,942mn with margin at 12.6%. We expect an EBITDA CAGR of 20.3% and a PAT CAGR of 27.5% in FY24-27E, given strong SSSG and robust store network expansion.

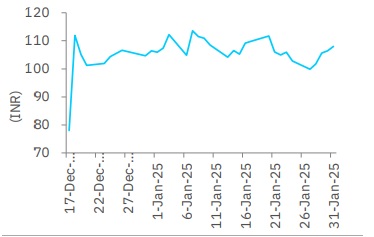

Price chart

Source: Bloomberg

Retail space CAGR at 10.9% in FY24-27E:

VMM’s retail space expanded 7.2% to reach ~11.8mn sqft as at end-Q3FY25. On net basis, VMM opened 23 stores in Q3 and 57 in 9MFY25, taking the total store count to 668, with no store closures in Q3 and one store closed in 9MFY25. VMM added 18 cities in Q3 to reach 432 cities from 414 in Q2FY24. We expect the network to reach 686 stores in FY25E, 766 stores in FY26E and 846 in FY27E. We expect retail space addition CAGR of 10.9% in FY24-27E.

Reiterate Buy with TP maintained at INR 140:

We prefer VMM given its strong panIndia store expansion potential, robust category mix tilted towards apparel and general merchandise with higher share of private labels and cash rich balance sheet. We maintain our estimates. Expect 27.5% PAT CAGR in FY24-27E, led by store expansion and higher SSSG. We maintain Buy with TP retained at INR 140, on 66x FY27E P/E. Key risks to our call are slower-than-expected pace of store expansion and weaker SSSG.

Please refer disclaimer at Report

SEBI Registration number is INH000000933