Neutral Prudent Corporate Advisory Ltd for the Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

Strong MF momentum; insurance outlook muted by regulations

* Prudent Corporate Advisory (Prudent) reported an operating revenue of INR3.2b, +12% YoY (in-line) in 2QFY26, fueled by an 11% YoY surge in commission and fees income. For 1HFY26, it grew 15% YoY to INR6.1b.

* Operating expenses grew 14% YoY to INR2.5b (in-line); fees and commission expenses rose 17% YoY, employee expenses grew 11% YoY, and other expenses were flat YoY. EBITDA grew 5% YoY to INR722m (6% beat), reflecting an EBITDA margin of 22.6% (vs. 24% in 2QFY25 and our est. of 22.3%).

* Lower treasury income led to in-line PAT (up 4% YoY/3% QoQ) to INR535m. For 1HFY26, it grew 10% YoY to INR1.1b.

* Based on the latest GST implications, management indicated that ~30% of the life insurance business is expected to be impacted, facing an est. ~18% revenue cut, while ~70% of the health segment will also be affected, with the final impact currently under negotiation and expected to be assessed post-Dec’25.

* We raise our earnings estimates by 1%/3%/5% for FY26/FY27/FY28, reflecting higher expected yields on MF business and robust AUM growth driven by the Indus Capital MF acquisition and sustained SIP flows. We expect Prudent to deliver a revenue/EBITDA/PAT CAGR of 22%/22%/24% over FY25-28. We reiterate our Neutral rating with a TP of INR2,800 (based on 35x EPS Sep’FY27E).

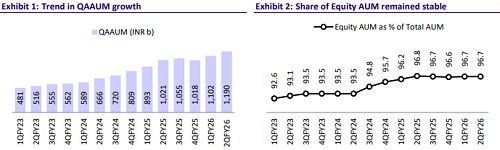

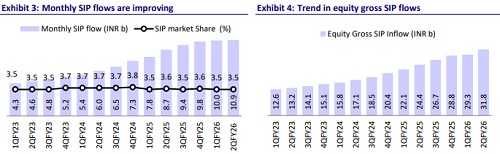

QAAUM sustains the growth momentum as SIP flows remain strong

* Prudent’s QAAUM grew 17%/8% YoY/QoQ to INR1.2t, with Equity AUM rising 13% YoY, led by record high net sales during the quarter. Monthly SIP flow grew to ~INR10.9b (guidance to be at ~INR12 per month by Mar’26) from INR8.7b in 2QFY25, reflecting a market share of ~3.5%.

*Total insurance premium for the quarter came in at INR1.9b (+21% YoY), of which life insurance premium stood at INR1.4b (+20% YoY) and general insurance premium stood at INR481m (+26% YoY).

* Commission and fees income rose 11% YoY to ~INR3.2b, of which INR2.7b (+16% YoY) was contributed by the distribution of MF products, while the contribution from insurance products declined 4% YoY to INR324m.

* Revenue from the distribution of MF grew 16% YoY/9% QoQ to INR2.7b, fueled by strong SIP inflows and active participation from MFDs.

* Revenue from the sale of the insurance segment grew ~11.5% QoQ to INR324m, led by strong traction in fresh retail health premiums, which jumped 33% YoY to INR1.6b.

* Revenue from the stockbroking segment dipped 40% YoY to INR44m. Revenue from other financial & non-financial products declined 8% YoY to INR83m.

* Commission & fee expenses rise 10% QoQ to INR1.9b, driven by INR20m of additional trail commission (management guided lower commission provisioning in 2HFY26).

* Other income was up 4% YoY but declined

Key takeaways from the management commentary

* With the acquisition of Indus Capital MF, management expects annual revenue contribution of ~INR220–230m (annualized), accruing from Q3FY26.

* Prudent remains highly optimistic about the Structured Investment Funds (SIF) opportunity, though current participation is still limited — with only ~200 certified distributors versus 3,000+ industry-wide. The two NFOs launched under this segment together generated revenues of INR90–100m.

* The recent consultation paper on AMCs highlighted 1) a 5bp cut from exit load benefit removal (impacting industry TERs by ~4.0–4.5bp) and the proposed brokerage cost reduction on cash (to 2bp) and derivatives (to 1bp) — are anticipated to collectively lower total expense ratios by ~6–7bp across the ecosystem, with the impact likely to be shared among AMCs, distributors, and investors.

Valuation and view

* Prudent continues to deliver strong growth in its mutual fund distribution business, aided by healthy SIP inflows, steady yields, an expanding MFD network, and incremental contribution anticipated from the Indus Capital MF acquisition.

* However, regulatory headwinds remain a near-term concern — including the draft proposals on TER rationalization for AMCs and potential GST exemption implications, which could affect ~30% of the life insurance business and ~70% of the health insurance portfolio. While these factors may exert some short-term pressure on earnings, Prudent is expected to partially pass on the impact to distributors on a proportionate basis.

* We raise our earnings estimates by 1%/3%/5% for FY26/FY27/FY28, reflecting higher expected yields on MF business and robust AUM growth driven by the Indus Capital MF acquisition and sustained SIP flows. We expect Prudent to deliver a revenue/EBITDA/PAT CAGR of 22%/22%/24% over FY25-28. We reiterate our Neutral rating with a TP of INR2,800 (based on 35x EPS Sep’FY27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412