Neutral Mangalore Refinery & Petrochemicals Ltd For Target Rs. 159 By Yes Securities Ltd

Performance better than expectations on higher GRMs, supported by better products realization on exports

Mangalore Refinery Petrochemical’s Q3FY25 core performance was a beat with an EBITDA of Rs 10.3bn; a USD6.21/bbl of reported GRM (our est. USD5.4) on improved realizations of exported products which are now at par with the domestic and international prices. The Russian crude discounts continued to be lower ~USD2/bbl adding marginal benefit. As per our calculations, the inventory gain could be at USD0.03/bbl. There was no impact of SAED during the quarter. We maintain NEUTRAL rating on stock with a revised TP of Rs159.

Result Highlights

* EBITDA/PAT at Rs bn 10.3/3.04, better performance on QoQ basis and flattish on YoY. The reported GRMs are better than expectations on better exported products realization and supported by marginal inventory gains.

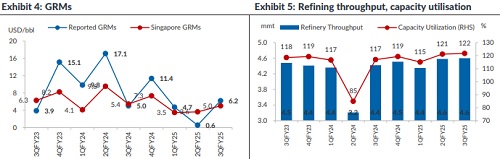

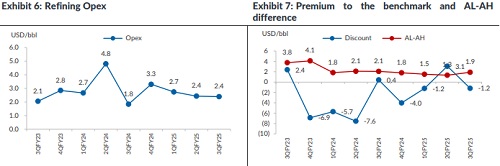

* MRPL’s Q3FY25 reported GRM was USD6.21/bbl (USD0.55 the previous quarter, USD5 a year ago) while the Arab heavy-light difference was USD1.9/bbl (lower than the prior quarter’s 1.3). The GRM was higher than our expectations of USD5.4/bbl. Higher exports (~32% of revenue) where the product realization were now at par with the domestic and international prices which lead to an improvement over H1FY25 where it was sold at a discount. The assumed core GRM at USD6.18/bbl (USD3.48 the quarter prior, USD7.5 a year back) was at a premium of USD1.18/bbl to the benchmark of USD5.0. The Russian crude discounts continued to be lower ~USD2/bbl adding marginal benefit. As per our assumptions, the Inventory gains could be at USD0.03/bbl (Rs87mn) versus a loss of USD2.93 the previous quarter and USD2.5 a year ago. Refinery throughput was 4.6mmt at ~122% utilisation (121% the prior quarter, 117% a year ago).

* The opex stood lower at USD2.4/bbl, lower than 8-qtr average of 2.8. There was a higher sourcing of RLNG which could be 0.6mmsmcd (versus last quarter’s 0.5mmscmd) and has a peak potential of 0.65mmscmd. The Rs 1.61bn forex loss impacted the profitability.

* Capex for the quarter was Rs2bn, (9MFY25 at Rs 5.87bn), FY25 capex is targeted at Rs 9bn. The debt stood at Rs133bn, up Rs514mn QoQ and down Rs7.2bn on YoY basis. The marginal sequential increase is due to working capital requirements.

* Crude sourcing mix. Russia at 45%, Saudi 25%, Iraq 10%, domestic 20%. MRPL also sourced ONGC KG 98/2 crude in this quarter which is priced marginally below the Indian crude basket price. In terms of the slate mix, the contribution of diesel to slate was ~45%, gasoline ~14%, ATF ~10%, LPG ~7% and fuel & loss 10.4%.

* Retail outlets: It has 123 operational retail outlets (+5 QoQ) and targeting 1,000 outlets by FY27, initially focusing in southern India, post which it plans to expand in the West and Northern part of India. MRPL outlets doing better than competitors by ~20-30kl per outlet at 150kl/month.

* 9MFY25 performance: EBITDA at Rs 11.63bn (vs Rs 53.7bn last year) while PAT loss at Rs 3.1bn (vs a profit of Rs 24.6bn previous period last year) and the reported GRM at USD3.8/bbl (vs USD10).

Valuation

The GRM sensitivity for the stock is high: a $1/bbl change in GRM changes EBITDA by Rs 10.3bn. BV/share for FY25e/26e/27e: Rs 76.3/85.3/92.9; debt:equity at 0.9/0.8/0.6x FY25e/26e/27e vs 0.9x in FY24. At CMP, stock trades at 17x/7.8x/8.7x FY25e/26e/27e EV/EBITDA & 1.9x/1.7x/1.6x P/BV. We maintain NEUTRAL rating on stock with a revised TP of Rs159, valuing the stock at 9.5x FY27e EV/EBITDA.

Acquisition

MRPL has acquired 1,34,80,000 equity shares of Mangalore SEZ Limited (MSEZ) from IL&FS at a revised price of Rs 48.708/shr, amounting to Rs 656.6mn, increasing its equity stake from 0.96% to 27.92%. The acquisition, executed under IL&FS’s "Right of First Refusal" to ONGC/MRPL, enhances MRPL's control over MSEZ, a multi-product SEZ operating since 2014, which spans 1,607 acres with ~85% area leased out and investments exceeding USD 2bn. MSEZ’s primary business includes industrial land leasing and utility services, supporting tenants like MRPL’s Aromatic Complex, Syngene, and ISPRL. With exports worth USD 3.2bn and a turnover that rose to Rs 3.45bn in FY23 before moderating to Rs 1.88bn in FY24, this acquisition strategically positions MRPL to capitalize on MSEZ’s infrastructure and operational potential for long-term growth. The Indicative timeline for completion is 1 year.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632