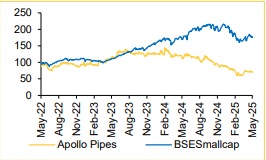

Buy Apollo Pipes Ltd For Target Rs. 477 - Choice Broking Ltd

Management Guidance on Volume and Margins is Aggressive But Achievable in Our View

We maintain BUY rating on Apollo Pipes (APOLP) with a revised target price of INR 477/share as : 1) We factor in robust volume CAGR of 24% over FY25-28E driven by better demand and market share gains from unorganized players in the pipes business. Higher infra spends by state and central governments coupled with the demand boost from construction completion of the Real Estate projects launched between FY22 to FY25, would help drive volume growth for pipes sector during FY26-28E.

2) We factor in EBITDA margin improvement of 190 bps over FY26-28E driven by a) operating leverage benefit due to strong volume growth, b) margin improvement in the Kisan Mouldings asset due to initiatives by APOLP and c) improving contribution from higher margin products like OPVC.

3) We forecast APOLP EPS to grow at a CAGR of 61.7% over FY25-28E, basis our volume CAGR of 24%, and realisation CAGR of 2% over the same period. As a result of points 1), 2) and 3) noted above, consol RoCE is expected to almost triple from 6.7% in FY25 to ~18.3% in FY28E.

4) We incorporate a PEG ratio based valuation framework that allows us a rational basis to assign a valuation multiple that better captures earnings growth. We arrive at a 1-year forward TP of INR 477/share for APOLP. We assign a PEG ratio of 1x on FY25-28E core EPS CAGR of 61.7%, which we believe is a conservative multiple. This valuation framework gives us the flexibility to assign a commensurate valuation multiple based on quantifiable earnings growth and improvement in fundamentals.

We do a sanity check of our PEG ratio based TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 477, FY27E implied EVEBITDA/PB/PE multiples are 12.2x/2.3x/23x all of which are reasonable in our view. Higher volatility in PVC resin prices, slowdown in infra spends by government are risks to our BUY rating.

Q4FY25: Volume disappointed with a QoQ decline.

Volumes came in at 25.9KT (-3.7% QoQ, +21.8% YoY). YoY volumes look higher due to Kisan Mouldings acquisition. However, the decline in QoQ volumes was a bit disappointing. ASP came in at INR 121,110 per ton (+6% QoQ, 1% YoY), which we believe is healthy despite raw material price volatility.

Overall, consolidated Revenue/EBITDA/PAT came in at INR 3,148Mn (+2.2% QoQ, +23.2% YoY) / INR 240Mn (+3.3% QoQ, -5.4% YoY) / INR 97.3Mn (+57% QoQ, +46% YoY). EBITDA came in-line with our estimates of INR 2,793/231/60Mn respectively.

Consolidated EBITDA per ton came in at INR 9,248 in line with CEBPL estimates of INR 9,150 per ton. The company announced a dividend of INR 0.7/sh.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131