Accumulate Mangalore Refinery & Petrochemicals Ltd For Target Rs.152 by Prabhudas Liladhar Capital Ltd

Strong GRM drives earnings

Quick Pointers:

* Core GRM at US$5.9/bbl with inventory loss of USD2/bbl

* Lower throughput, higher implied opex, inventory loss result in net loss of Rs2.7bn

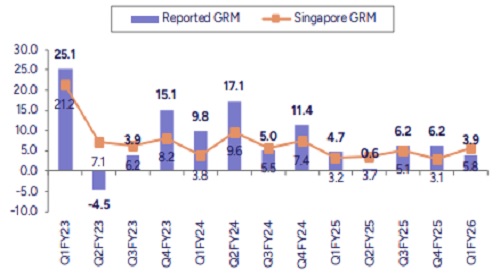

Mangalore Refinery & Petrochemicals (MRPL) had a partial shutdown in the quarter due to which, throughput declined from 4.6mmt in Q4FY25 to 3.5mmt. Decline in oil prices resulted in inventory loss of USD2/bbl, worsening the reported GRM from USD6.23/bbl in Q4FY25 to USD3.9/bbl. Higher shutdown related costs further worsened EBITDA to Rs1.8bn (Ple Rs11.8bn, BBGe Rs10.9bn, -70% YoY, -84% QoQ). Poor EBITDA resulted in PAT loss of Rs2.7bn in the quarter. We build in a core GRM of USD7.1/7.5/bbl for FY26/27E. The stock is currently trading at 14.3/10.9x FY26/27 EPS and 7.5/5.9x FY26/27E EV/EBITDA. We upgrade our rating from ‘HOLD’ to ‘ACCUMULATE’ rating on the stock with a TP of Rs152 due to expected strength in the coming quarter in GRM as well as inventory gains. Our target price is based on 5x FY27 EV/EBITDA and adding the option value ofRs45 for its chemicals foray.

* Core GRM improves marginally, inventory loss drags: The company reported a core GRM of USD5.9/bbl vs USD3.8/bbl in Q1FY25 and USD5.8/bbl in Q4FY25. However, inventory loss of USD2/bbl resulted in reported GRM of USD3.9/bbl vs USD4.7/bbl in Q1FY25 and USD6.2/bbl in Q4FY25.

* Throughput declines due to partial shutdown: Throughput stood at 3.5mmt during the quarter against 4.4mmt in Q1FY25 and 4.6mmt in Q4FY25. Shutdown also resulted in implied opex standing at USD3.6/bbl vs USD2.8/bbl in Q1 & Q4FY25.

* Concall Highlights: 1) plant shutdown and inventory loss of USD2/bbl resulted in loss 2) shutdown resulted in additional cost of USD2/bbl 3) capex during the quarter stood at Rs5.4bn, expected to rise to Rs10bn by year end 4) expect to add 100 retail outlets to the current 170 outlets 5) sold 68,000kl during the quarter, expected to sell 500tkl in FY27 6) HSD is 38-40% of the product slate 7) one refinery each in California and UK has been announced for closure 8) reformate added USD0.5/bbl to the refining margin 9) gross debt stands at Rs136bn 10) 11.4% fuel & loss due to the shutdown compared to 10% during normal operations; also targeting reduction of 1% in fuel & loss 11) factory acceptance test for IBB has been completed; mechanical completion of IBB pilot plant to be completed by Aug’25 and plant trials to start by Sep’25post customer approval, full scale plant would come up

Reported GRM declines due to inventory loss (USD/bbl)

Above views are of the author and not of the website kindly read disclaimer