Hold Archean Chemical Industries Ltd For Target Rs.615 by Axis Securities Ltd

On Path of Steady Recovery; Maintain HOLD

Est. Vs. Actual for Q1FY26: Revenue: MISS; EBITDA: MISS; PAT: MISS

Changes in Estimates Post Q1FY26

FY26E/FY27E: Revenue: -5%/9%; EBITDA: -9%/9% ; PAT: -12%/10%

Recommendation Rationale

* Signs of Improvement despite Persistent Pressure in Bromine: The company posted a strong 67% YoY increase in industrial salt volumes during the quarter, while bromine volumes continued to decline on a YoY basis. Despite the prolonged weakness in pricing over the past few years, the bromine segment remained partly insulated due to long-term contractual arrangements. In line with previous guidance, the company maintained its salt volume run rate at 1.1 Mn tonnes and expects further improvement in the coming quarters. Earlier operational bottlenecks, particularly in logistics, have been largely resolved.

* SOP & Bromine Derivatives to Contribute Meaningfully: The SOP segment continues to show encouraging momentum, with trial runs progressing steadily. The company is working closely with its technology partner to move from pilot-scale to full-scale plant trials. Initial contributions from this vertical are expected in H2FY26. In the bromine derivatives segment, including CBF and PTA synthesis, current capacity utilisation stands at 30–40%, with positive customer feedback. Management expects utilisation to exceed 50% in the near term, indicating improving traction.

* Growth Likely to Pick Up from FY27: With strong demand visibility and long-term customer contracts across Asia, the company remains confident of sustaining current volume levels. While recovery during the quarter was below expectations, rising capacity utilisation and a potential uptick in pricing are likely to accelerate growth from end-FY26 or early FY27.

Sector Outlook: Neutral

Company Outlook & Guidance: The company is witnessing mixed trends across the chemical industry, with early signs of recovery in a few segments. Enquiry levels are steadily improving, indicating a more favourable business environment in the coming quarters and the year ahead. The company maintains a positive outlook on its bromine derivatives project and the recently acquired Oren business, which is expected to contribute meaningfully to revenue in the current fiscal year. However, management remains cautious as project ramp-up and technical approvals are progressing slower than initially anticipated. Strong and sustained demand is expected to continue in the industrial salt segment, while the SOP business is projected to recover beginning FY26.

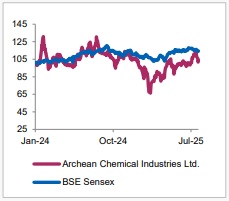

Relative Performance

Current Valuation: 10x FY27E (Unchanged)

Current TP: Rs 615/share (Earlier: Rs 560/share)

Recommendation: We maintain our HOLD rating on the stock.

Financial Performance: Although the company posted respectable YoY growth, the performance missed our estimates on all fronts. Consolidated revenue stood at Rs 292 Cr, up 37% YoY and down 15% QoQ, missing our estimate by 26% and signalling a delay in full recovery. EBITDA was Rs 78 Cr, up 10% YoY and down 12% QoQ, falling short of our estimates by 36%. The EBITDA margin stood at 26.7%, down 676 bps YoY and up 116 bps QoQ. The company's PAT was Rs 40 Cr, a drop of 10% YoY, majorly missing our estimate by 51%.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633