Neutral Bank of Baroda Ltd for the Target Rs. 250 by Motilal Oswal Financial Services Ltd

Business growth steady; near-term margins under watch

Slippages increase QoQ

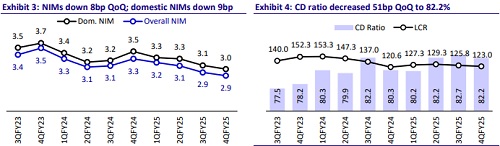

* Bank of Baroda (BOB) reported 4QFY25 PAT at INR50.5b (3% YoY growth, largely in line), though NII missed estimates. NIMs contracted 8bp QoQ to 2.86%.

* NII declined 3.5% QoQ to INR110.2b (5.5% miss), while other income grew 24% YoY to INR52.1b (14% beat), supported by the reversal of SR provisions of INR4.9b.

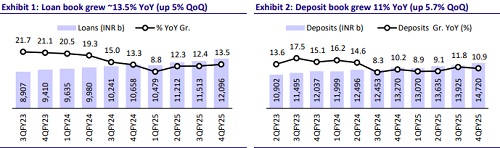

* Provisions were elevated INR15.5b (3.6% higher than MOFSLe), up 43% QoQ. Business growth was steady at 12% YoY, with advances growth at 13.5% YoY/ 5.1% QoQ, while deposits grew 10.9% YoY/5.7% QoQ. CD ratio moderated to 82.2% (down 51bp QoQ).

* Slippages increased 8% QoQ. Higher write-off and better recoveries led to improvement in the GNPA ratio 17bp QoQ to 2.26%, while NNPA improved 1bp QoQ to 0.58%. PCR declined to 75% vs 76% in 3QFY25.

* We tweak our FY26E/FY27E EPS estimates by +0.7%/-1.5% and estimate FY27E RoA/RoE at 1.08%/15.4%. Reiterate Neutral with a TP of INR250 (0.9x FY’27E ABV).

Advance growth healthy; CD ratio eases slightly to ~82.2%

* PAT grew 3.3% YoY (up 4.3% QoQ) to INR50.5b (inline). NII declined 3.5% QoQ (5.5% miss) as NIMs contracted 8bp QoQ to 2.86%. FY25 PAT stood at INR195.8b (up 10.1% YoY). We expect PAT to grow 4.3% YoY to INR204.2b for FY26.

* Other income grew 24% YoY to INR52.1b (14% beat on MOFSLe), amid better core fee and treasury income and reversal of SR provisions.

* Opex grew 2.8% YoY/ 7.7% QoQ to INR80.9b (in line). PPoP stood at INR81.3b, up 6.1% QoQ/flat YoY (3% miss).

* Provisions came in higher at INR15.5b (up 43% QoQ, 3.6% higher than MOFSLe). PCR declined to 74.9% vs 76% in 3QFY25.

* Advances grew at a healthy 13.5% YoY (up 5.1% QoQ). Among segments, retail book grew faster at 5.5% QoQ, while corporate book grew 6.4% QoQ. In Retail, home loans rose 5.7% QoQ, mortgage loans grew 6.8% QoQ, and gold loans grew faster at 8.3% QoQ.

* Deposits grew 10.9% YoY/5.7% QoQ, led by faster growth in current deposits. Domestic CASA mix , thus, inched up 64bp QoQ to ~40%.

* On the asset quality, slippages increased to 1%. However, recovery and accelerated write-offs led to 17bp QoQ improvement in GNPA ratio to 2.26%. NNPA ratio declined 1bp QoQ to 0.58%. SMA 1/2 declined to 33bp.

* RoA remained flat at 1.16% in 4Q, while RoE came in at 17.49%.

Highlights from the management commentary

* NIMs are expected to be maintained at 3% in FY26, similar to FY25-exit-quarter levels, with 1Q26 witnessing continued pressure. NIMs are expected to see some improvement from 2HFY26 onwards.

* Loan book composition - Repo book stood at 34%, MCLR stood at 45-48%, and Fixed rate loan mix was at low single-digit.

* Segment-wise growth is expected to remain the same. Corporate book is expected to stand at 10% YoY. RAM is expected to grow at 15% YoY.

* There was a recovery from write-off accounts in 4QFY25, with the large corporate account being 100% provided for. Recovery rate in FY26 is expected to be at similar levels as FY25.

Valuation and view: Reiterate Neutral with a TP of INR250

BOB reported an operationally weak quarter, with NII reporting a miss, while provisions also came in higher. NIMs contracted to 2.86% amid pressure on the cost of funds and yields getting repriced lower. Management expects NIMs for FY26 to remain at the same level as of exit quarter of FY25, with 1H being on the downward bias and recovering in 2HFY26. Business growth was steady, with advance growth at 12% YoY/5.4% QoQ. Slippages were slightly elevated, while PCR declined to 75% vs 76% in 3QFY25. We tweak our FY26E/FY27E EPS estimates by +0.7%/-1.5% and estimate FY27E RoA/RoE at 1.08%/15.4%. We remain watchful on the elevated CD ratio at 82.2% and higher dependency on the bulk deposits, which are expected to keep NIMs under check. Maintain Neutral rating on the stock with a TP of INR250 (0.9x FY’27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412