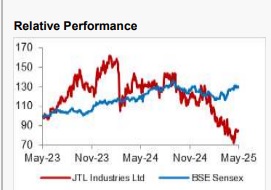

Hold JTL Industries Ltd For Target Rs. 78 By Axis Securities Ltd

Est. vs. Actual for Q4FY25: Revenue – BEAT; EBITDA/t – MISS; PAT – MISS

Change in Estimates post Q4FY25

FY26E/FY27E: Revenue: -11%/-15%; EBITDA: -20%/-23%; PAT: -21%/-25%

Recommendation Rationale

Weak Q4FY25 performance: JTL’s EBITDA de-grew by 51%/49% YoY/QoQ, a 47% miss vs our estimate with the EBITDA/t at Rs 2,176/t (down 51%/46% YoY/QoQ), a 47% miss vs. estimate, led by higher RM, employee and other expenses. It took some margin hit on export orders booked in Q3FY25, which it delivered in Q4FY25, due to a rise in HRC prices QoQ. An increase in other expenses was mainly due to higher freight charges due to higher exports.

FY25 performance: FY25 Revenue degrew by 6% YoY, mainly led by lower sales realisation as benchmark HRC prices fell by 10% YoY in FY25. Sales volume grew only by 13% YoY (including Nabha Steel) as capacity addition was skewed in H2FY25. Higher other expenses due to higher exports on account of lower government orders led to a decline in EBITDA at Rs 123 Cr (down 19% YoY) with EBITDA/t down to Rs 3,557/t (from Rs 4,452/t in FY24).

EBITDA/t trajectory likely to improve in FY26: EBITDA/t is likely to improve in FY26 towards the Rs 4,200-4,400/t range, led by guidance of 2 Lc tonnes of VAP products over total sales volume guidance of 5 Lc tonnes. The current installed capacity is now at 9.36 Lc tonnes with 3 Lc tonnes of backwards integration. Mangaon capacity is now at 4.5 Lc tonnes, which includes 2.5 Lc tonnes of DFT (Direct Forming Technology) installed in Q4FY25. DFT ramp-up from Q1FY26 will contribute to a higher VAP share.

Sector Outlook: Cautiously Positive

Company Outlook & Guidance: The company’s capacity will grow to 2 MT through the Mangaon plant (1.5 MT expansion) by FY27. We cut our EBITDA estimates as we factor in lower sales volume than our earlier assumptions. In FY26, sales volume guidance is ~5 Lc tonnes (our earlier estimate was at 5.5 Lc tonnes) with ~125 kt in Q1/Q2FY26 each and then gradually increasing in H2FY26. Capex guidance for FY26 is in the range of Rs 240-250 Cr.

Current Valuation: 20x P/E on Mar’27E EPS (from 22x P/E on Mar’27E EPS)

Current TP: Rs 78/share (Rs 115/share)

Recommendation: We downgrade from BUY to HOLD rating on the stock.

Financial Performance:

JTL Industries posted a weak set of numbers with EBITDA coming below our estimates. Revenue stood at Rs 469 Cr (up 1%/4% YoY/QoQ), ahead of our estimate due to a higher than estimated ASP. EBITDA, however, missed our estimate by 47% at Rs 18 Cr (down 51%/49% YoY/QoQ), led by higher costs across line items. RM, employee, and other expenses increased YoY/QoQ. EBITDA/t declined by 51%/46% YoY/QoQ and missed our estimate of Rs 4,100/t to Rs 2,176/t. PAT stood at Rs 17 Cr (down 43%/33% YoY/QoQ) and missed our estimate due to EBITDA miss, partially offset by higher other income. The company declared a DPS of Rs 0.125/share for FY25.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633