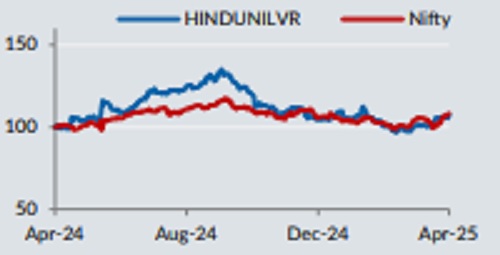

Add Hindustan Unilever Ltd for the Target Rs. 2,540 by Axis Securities Ltd

Near-term margin guidance revised downwards

Hindustan Unilever’s (HUVR) 4QFY25 headline performance was largely in-line. Operating margins were only slightly lower than our expectation. Absolute volume tonnage grew in mid-single digit, but it was partially offset by a negative mix. Underlying Volume Growth (UVG) thus grew by ~2% (vs est. 0.5%). Commentary for the very near-term highlights company’s focus to turnaround growth but this will on the back of margin sacrifice. HUVR now expects gross margins to moderate over the very near-term. This along with stepping up of investments have led to EBITDA margin guidance being revised lower by a 1% to 22- 23%. Consequently, in our model, FY26 earnings growth will again be in single digit versus a double-digit growth expectation earlier. There is a 6%/4.8% downward revision in our FY26E/FY27E EPS. Targeting ~50x on FY27E EPS, we now get a revised target price (TP) of Rs2,540 (Rs2,670 earlier). Maintain ADD.

Result Highlights

* Headline performance: Standalone turnover (including other operating income-OOI) for 4QFY25 grew by 2.4% YoY to Rs152.1bn (vs est. Rs152.5bn). EBITDA was up 0.9% YoY at Rs34.7bn (vs est. Rs35.4bn). Recurring PAT (PAT bei) was up 4.2% YoY to Rs25bn (vs est. Rs25bn). Reported PAT grew by 3.6% YoY to Rs24.9bn.

* UVG for 4QFY25 came at ~2%, slightly above our est. of 0.5%.

* Margins (Please note, our margins calculated with revenue (Sales+OOI) in denominator and not sales.): Reported gross margin came in at 50.5%, down ~140bps YoY (-20bps QoQ). While EBITDA margin was down 30bps YoY at 23.2% (~40bps below our est.). A&SP was down 110bps YoY to 9.6% (down 8.3% on absolute basis). Other expenses and Staff costs were flattish YoY.

* FY25 performance: Revenue, EBITDA and Recurring PAT grew by 1.7%, 0.7% and 1.1% YoY, respectively. Gross margin was down 60bps YoY to 50.9% while EBITDA margin was down 20bps YoY to 23.2%

Key near-term outlook

(1) Expect 1HFY26 growth to be better than 2HFY25. (2) At current commodity prices, price growth for HUVR is expected to be in the low-single digit range in the near future. (3) With expectation of moderation in gross margins and stepping up of investments, EBITDA margin guidance for the next 2-3 quarters have been revised downwards to 22-23%.

View & Valuation

Model changes has led to 6%/4.8% downward revision in our FY26E/FY27E EPS. Gradual improvement in growth along with low-single digit pricing (anniversarization of earlier price actions + price cuts in some part of the portfolio offsetting hikes in other part) and a downward revision in EBITDA margins to 22-23% band (calculated on sales) leads to just ~5% earnings growth in FY26 versus a double-digit growth expectation earlier. Over FY25- 27E, we now expect HUVR to deliver ~6.9% revenue CAGR led by ~5% volume CAGR. With gross margin recovery delayed, we believe EBITDA margin will now see a modest improvement of ~30bps over FY25-27E. Thus, leading to a subdued 8.1% earnings CAGR over the same period. HUVR is now currently trading at ~51x/46x on our FY26E/FY27E EPS. Since the valuations are relative reasonable, we hold our rating to ADD and a revised TP of Rs2,540 (Rs2,670 earlier), targeting 50x on FY27E EPS.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633