Diwali Muharat Pick : Buy Jenburkt Pharmaceuticals Ltd for the Target Rs.1,370 by Sushil Finance

FUNDAMENTAL DRIVERS SHAPING JENBURKT PHARMA’S FUTURE GROWTH

Jenburkt Pharmaceuticals’ revenue growth is largely driven by its strong presence in the branded generics market in India, supported by an extensive distribution network across urban and rural regions. With deep engagement across over 200,000 doctors and 400,000 pharmacies, the company ensures strong prescription momentum and market reach. Its balanced product portfolio across acute and chronic therapies, coupled with a steady pipeline in high-growth areas like dermatology, strengthens its competitive positioning. Nervijen, one of the company’s key revenue drivers, has strengthened its market presence, securing the 6th position in the Indian Vitamin, Mineral, and Nutrients (VMN) segment as of February 2025 (IQVIA), underscoring its growing traction in a competitive landscape. Emerging export opportunities in markets such as Africa and prudent financial management further provide a foundation for sustained expansion. Together, these factors enable Jenburkt to deliver consistent, scalable, and diversified revenue growth.

ROBUST EARNING PERFORMANCE SUPPORTED BY COMPELLING VALUATION MULTIPLES

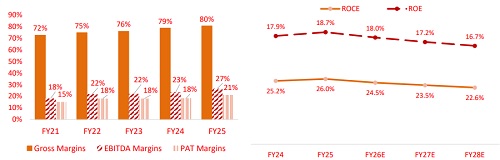

Jenburkt Pharmaceuticals consistently delivers strong profitability, supported by its focus on branded generics, asset-light model, and disciplined cost structure. With high-margin therapies and efficient operations, the company achieved FY25 Gross Margins, EBITDA, and PAT margins of 80%, 27%, and 21% respectively, reflecting superior pricing power and cash conversion. Its net debt-free balance sheet, robust free cash flow generation, and high return ratios (ROE 26%, ROCE 19%) underscore strong capital efficiency. Despite this solid financial profile, the stock trades at attractive valuations relative to peers, offering scope for re-rating as growth catalysts unfold through domestic scale-up and export expansion.

INDIAN PHARMA INDUSTRY – GLOBAL LEADERSHIP AND SUSTAINED GROWTH

According to industry reports, the Indian pharmaceutical industry is projected to grow at a compounded annual growth rate (CAGR) of ~12% during 2020–2030, reaching USD 130 billion by 2030 from USD 41.7 billion in 2021. While the sector delivered a healthy CAGR of ~13% over the past two decades, growth has moderated to ~8.5% in the last decade and further to ~6.2% over the past five years. However, increased investments in R&D in recent years are expected to drive innovation and improve long-term growth prospects. Furthermore, supportive government policies, rising healthcare expenditure, and robust export opportunities are likely to act as key enablers for sustaining industry growth momentum over the medium to long term.

OUTLOOK & VALUATION

We expect Jenburkt Pharmaceuticals Ltd. to deliver top-line growth of 10–11%, with profitability sustained at 26–27%, underpinned by its robust domestic market position. The company’s leading products, Nervijen (ranked 6th nationally) and Powergesic, are expected to drive continued traction and support revenue expansion over the near to medium term. Furthermore, we estimate the company to sustain healthy profitability, with EBITDA and PAT margins at ~27% and ~22%, respectively, in FY28E. Our EPS estimates stand at Rs. 82.1, Rs. 91.5, and Rs. 101.5 for FY26E, FY27E, and FY28E, respectively. Assigning a target P/E multiple of 13.5x FY28E EPS, we arrive at a fair value of Rs. 1,370 per share, implying an upside of ~36.3% from the current market price of Rs. 1,005. With an investment horizon of 24–30 months, we reinstate coverage on Jenburkt Pharmaceuticals Ltd. with a BUY rating.

KEY RISK

* Foreign Exchange Fluctuation Risk: The company has its operations in Africa and other countries, and forex translation gain/loss may have a substantial impact on the financials of the parent. However, the risk is mitigated at a certain extent as the company’s export of its total revenues is ~13%

* Competition Risk: The products manufactured by the company are generally off patent and for general usage; this can create competition risk.

Please refer disclaimer at https://www.sushilfinance.com/Disclamier/disclaimer

Member : BSE/ NSE/ MSEI. SEBI Registration No.-INZ000165135