Capital Market : Gradual growth across parameters at the onset of FY26 by Motilal Oswal Financial Services Ltd

Gradual growth across parameters at the onset of FY26

ADTO remains stable; MF AUM and SIP at an all-time high

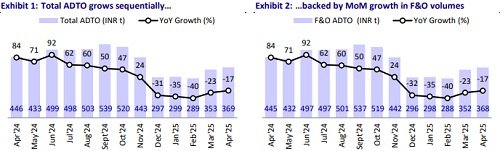

* In Apr’25, total ADTO continued to recover, growing 5% MoM to INR369t. While cash activity witnessed the adverse impact of market volatility, F&O ADTO experienced 5% MoM growth, with overall ADTO growing 2% MoM to INR1.1t.

* Retail participation surged across both cash and F&O segments, with retail cash ADTO growing 12% MoM to INR424b and retail futures and options premium ADTO rising 12% MoM to INR651b.

* The commodity market witnessed the highest activity with heightened volatility in crude oil and precious metals as ADTO achieved a new peak of INR3.3t in Apr’25 (+35% MoM).

* Demat additions remained low but stable MoM at 2.0m in Apr’25 (2.0m in Mar’25). We expect demat additions to gradually recover as macroeconomic conditions and market performance turn favorable.

* Mutual fund AUM grew ~4% MoM in Apr’25 to INR69.5t (up 22% YoY), achieving a new peak, with equity AUM growing 4% MoM to INR29.7t. SIP flows witnessed MoM growth after staying flattish and achieved a new high of INR266b.

* The capital market ecosystem maintained its growth revival for the second consecutive month in Apr’25, with some parameters such as commodity volumes, option premium turnover, and SIP flows witnessing strong growth. We expect the gradual growth of volumes as well as retail participation to help in achieving continued growth trajectory of brokers and exchanges. Further improvement in equity MF flows, backed by industry efforts to spread awareness and enhance financial literacy, will promote a long-term investment perspective that bodes well for AMCs. Our top picks in the sector are: ANGELONE, BSE, HDFCAMC, and Nuvama

Equity: Strong growth in option premium; BSE’s market share expands further

* Total ADTO grew 5% MoM in Apr’25 to INR369t, led by 5%/2% growth in F&O/ cash ADTO to INR368t/INR1.1t. The option premium ADTO grew 16% MoM to INR736b.

* In the cash segment, NSE maintains a dominant position with a 94% market share in Apr’25. However, BSE’s F&O market share continues to expand MoM. It had a notional turnover market share of 37.8% in Apr’25 (36.7% in Mar’25) and an option premium turnover of 21% (19.6% in Mar’25).

Commodities: Highest ever volumes recorded in Apr’25

* Total volumes on MCX grew 38% MoM to INR67.8t in Apr’25 (up 95% YoY), with ADTO reaching its highest ever level of ~INR3.3t. Option volumes grew 35% MoM to INR58.6t, while futures volumes grew 58% MoM to INR9.1t.

* The strong growth in options ADTO was largely due to an 18%/66%/384% MoM growth in crude oil/gold/silver ADTO. This was offset by a 23% MoM decline in natural gas volumes. Option premium grew 41% MoM to INR954b, reflecting a premium to notional turnover ratio of 1.63%.

* In commodity futures, growth was driven by 88%/67%/95% MoM jump in commodity futures ADTO, which was offset by a 24% MoM decline in natural gas ADTO.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Quote on Market Wrap 6th November 2025 by Mr. Ajit Mishra - SVP, Research, Religare Broking Ltd