India Strategy : Indian market manages double-digit gain in volatile CY25 by Motilal Oswal Financial Services Ltd

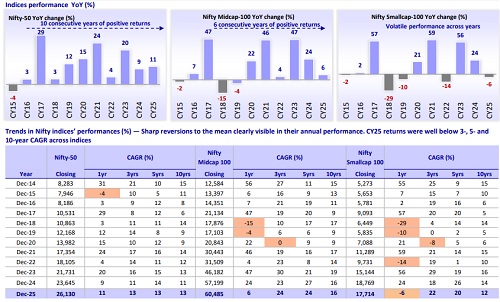

Nifty-50 posts gains for 10th consecutive year

* Indian equity markets delivered yet another year of positive returns despite a highly volatile environment. In CY25, the Nifty 50 rose 11% YoY, while the Nifty Midcap-100 gained 6% YoY. In contrast, the Nifty Smallcap-100 declined 6% YoY.

* Given the year of consolidation, returns remained well below the 3-, 5-, and 10-year CAGR.

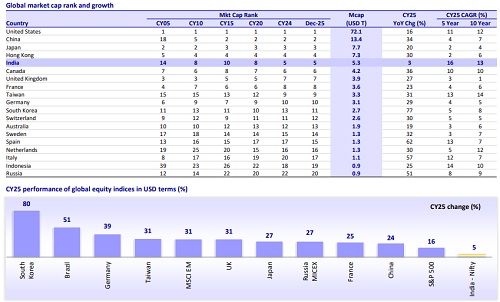

India lags global peers in CY25, remains among the top performers in the decade

* While India outperformed most global markets on 5- and 10-year CAGR, it was the weakest among most global markets in CY25. Sharp INR depreciation further weighed on USD-denominated returns for Indian equities.

* South Korea, Brazil, Germany and Taiwan emerged as the best-performing markets during the year.

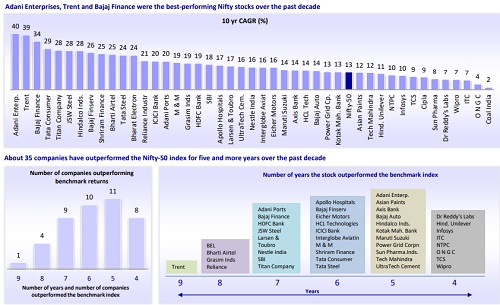

The outperformers and underperformers of the Nifty-50 over the past decade

* About 31 companies have outperformed the Nifty-50 on a 10-year CAGR basis.

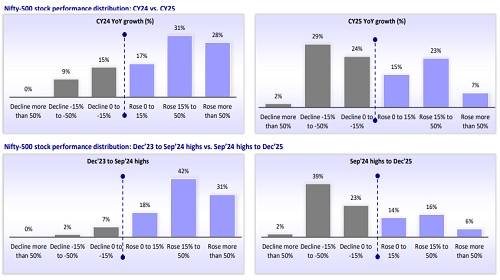

Market breadth flips: Strong CY24 participation gives way to CY25 correction

* One year of market consolidation and correction in broader markets has resulted in a sharply divergent picture of stock performance over the past two years, particularly when viewed relative to their respective highs.

* While about 76% of Nifty-500 constituents rose in CY24, nearly 55% posted declines in CY25.

* Similarly, although 73% of stocks gained more than 15% between Dec’23 and Sep’24, only 22% delivered gains above 15% between Sep’24 and Dec’25, highlighting the sharp shift in market breadth and momentum.

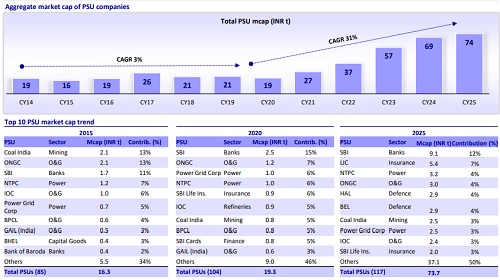

PSUs scale up as segment leadership changes

* Indian public sector undertakings (PSUs) have witnessed a significant increase in market capitalization over the past decade, rising 4.5x to ~INR74t by 2025. Most of this expansion has occurred since 2020, with PSU market capitalization growing 3.8x over the past five years.

* The evolving PSU landscape has also led to a notable reshuffling among the top 10 PSUs and across sectors. While commodities dominated PSU market capitalization in 2015, Financials and Defense have emerged as the leading sectors by 2025, with commodities slipping down the rankings. Notably, the top three PSUs by market capitalization, SBI, LIC, and NTPC, now together account for more market value than the entire PSU market capitalization in 2015

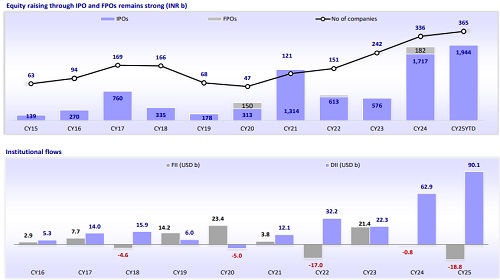

Record-high domestic flows and equity fundraising

* CY25 was another impressive year for the Indian primary market, with INR1.95t raised through more than 365 IPOs to date, surpassing the previous record of INR1.90t mobilized via 336 IPOs in CY24.

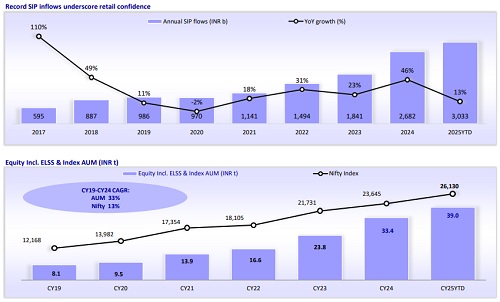

* Buoyant domestic participation drove DII inflows to a record high of USD90b, while total annual SIP flows rose 13% YoY to INR3t in CY25.

Stable SIP momentum supports record growth in MF AUM

* Monthly SIP flows remained consistently above USD3b throughout CY25. Supported by steady SIP inflows, Equity AUM reached an all-time high of INR39t by Nov’25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Morning Market Outlook : Nifty immediate support is at 23150 then 23050 zones while resistan...