Daily Derivatives Report 17cth October 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,424.8 (0.9%), Bank Nifty Futures: 56,987.2 (0.5%).

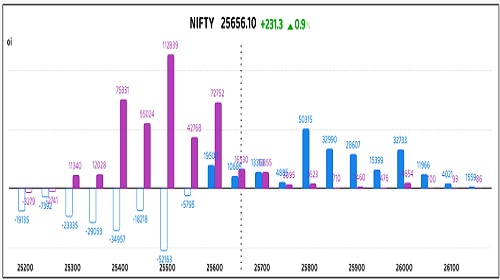

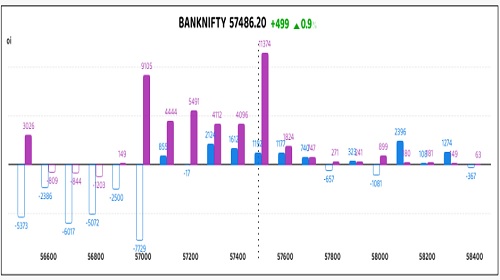

Nifty Futures and Bank Nifty Futures anchored yesterday's strong market rally, with both benchmark indices witnessing a significant rebound to a new three-month high. The market experienced an upside gap-up opening and maintained a positive trajectory throughout the session, reflecting a strong bullish undertone, driven primarily by robust domestic factors. Specifically, the Nifty Futures advanced by 231.3 points alongside a notable increase in open interest, signalling a Long Build Up. This open interest increased by 0.7% to 2 Cr (or 203.4 Lc) shares, with an absolute increase of 1,33,575 shares. Correspondingly, Bank Nifty Futures surged 499 points, also exhibiting a Long build-up indicated by an increase in open interest, which rose 1.8% to 19.8 Lc shares, a gain of 35,875 shares. This robust rally was largely attributed to positive sentiment fuelled by strong Foreign Institutional Investor (FII) inflows and continued optimism surrounding Q2FY26 earnings from sector heavyweights. The Nifty futures premium decreased significantly to 71 points from 101 points, while the Bank Nifty premium saw an even sharper contraction, falling from 187 points to 64 points. Sector-wise, performance was robust and broad-based, with most indices outperforming the Nifty, led prominently by sectors like Real Estate, Consumer Durables, and Banking. Despite the market surge, the India VIX (volatility index) saw a slight uptick of 3.2% to 10.86, suggesting a minor rise in expected volatility while remaining near historically low levels. Concurrently, the rupee strengthened for the second straight session, surging 21 paise to close provisionally at 87.87 against the US dollar on Thursday, buoyed by a softer American currency against majors and renewed risk-on sentiment among investors.

Global Movers:

US stocks finished down as the quality of loans at regional banks came into focus. The S&P 500 finished 0.6% lower as it reversed a similar gain earlier in the session, and ended at 6629. The Nasdaq 100 dropped 0.4%. Besides trade war related fears, it looks like the market has to now deal with cracks emerging in the creditworthiness of smaller banks. In related markets, the VIX jumped nearly 23% to over 25, while the dollar index and the 10-year yield continued their decline. Spot gold also continued with its now all-too-familiar story as it settled at $4326/ounce on credit fears becoming yet another tailwind. Elsewhere, brent prices dropped 1.4% and ended just above $61/barrel as investors focused on excess supply and the potential fallout from the US-China trade war.

Stock Futures:

Oberoi Realty Ltd. (OBEROIRLTY) surged 5.3% following its robust Q2FY26 earnings, which revealed a 28.9% YoY jump in consolidated net profit to Rs 760 Cr and a 34.7% YoY rise in operational revenue. The rally was underpinned by aggressive short covering, evidenced by a 6.9% decline in open interest with 999 contracts shed, bringing total futures OI to 13,501. In the options arena, call OI rose by 1,903 contracts to 7,483, while put OI climbed by 2,059 contracts to 5,268, lifting the Put-Call Ratio (PCR) from 0.58 to 0.70. The relatively higher addition in puts versus calls, despite the price uptick, suggests cautious optimism among option writers amid elevated volatility.

Nestle India Ltd. (NESTLEIND) advanced 4.5% as investors looked past a 17.4% YoY dip in Q2FY26 net profit, instead rewarding the company’s resilient sales trajectory, with total sales up 10.9% and domestic sales rising 10.8% on strong volume growth. The stock saw a Long Addition with futures open interest expanding 1.6% through 630 new contracts, totalling 40,635, and a widening premium to spot price by 0.7 points to 12.2. Options data revealed a notable build-up, with call OI increasing by 7,775 contracts to 17,949 and put OI surging by 10,533 contracts to 18,301. The heavier put accumulation signals hedging activity by option buyers, reflecting a defensive stance despite the bullish undertone.

KEI Industries Ltd. (KEI) faced a sharp 6% decline as profit booking and underwhelming Q2FY26 metrics, specifically a 9.9% EBITDA margin and marginal revenue miss, triggered selling pressure. The stock registered a Short Addition with futures open interest climbing 12.4% via 992 new contracts, reaching 8,980, while the futures premium to spot price contracted steeply by 42.1 points to 4.9. On the options front, call OI ballooned by 6,830 contracts to 11,126, whereas put OI rose modestly by 1,364 contracts to 4,224. The disproportionate call build-up amid price erosion suggests bearish positioning by option writers anticipating further downside.

RBL Bank Ltd. (RBLBANK) rallied 2.3%, hitting a fresh 52-week high intraday, propelled by renewed takeover speculation involving Emirates NBD Bank PJSC’s potential 51% stake acquisition. The stock saw a Long Addition with futures open interest jumping 17% through 3,759 new contracts, totalling 25,903, and a 0.75-point rise in futures premium to 2.95. In options, call OI increased by 1,135 contracts to 7,424, while put OI rose by 1,120 contracts to 3,908. The balanced build-up across calls and puts, coupled with rising futures interest, reflects heightened speculative activity with option buyers positioning for directional clarity amid acquisition buzz.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.38 from 1.21 points, while the Bank Nifty PCR rose from 1.1 to 1.18 points.

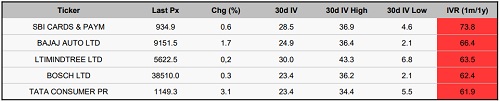

Implied Volatility:

SBI Cards & Payments and Bajaj Auto are currently exhibiting extreme volatility in the derivatives complex, driven by an unmistakable surge in risk perception. This is quantifiable through their exorbitant Implied Volatility Ranks, soaring to 74% and 66% respectively. The corresponding vigorous Expected Volatility metrics (29% and 25%) underscore market conviction regarding substantial near-term price divergence. This heightened risk premium has dramatically inflated option prices, leading to a prohibitive spike in margin and capital requirements for both sophisticated hedging operations and aggressive speculative engagements. Consequently, the resultant high-premium contracts have become economically unviable for traders pursuing capital-lean directional exposure. HDFC Life and Adani Ports In stark contrast, HDFC Life and Adani Ports are navigating a phase of anomalously subdued risk. Their relatively compressed Expected Implied Volatilities (21% and 25%) place them significantly below the prevailing F&O market average. This volatility compression has beneficially deflated option premiums, creating a singularly cost-effective landscape for executing directional strategies. For traders, establishing Long Call and Long Put positions on these assets now presents an optimized risk-reward profile, facilitating speculative exposure with materially reduced upfront capital outlay and a commensurately magnified payoff potential.

Options volume and Open Interest highlights:

Godrej Consumer Products (Godrej CP) and JSW Energy are exhibiting robust bullish conviction, evidenced by significantly elevated Call-to-Put Volume Ratios of 5:1 and 4:1, respectively. These skewed ratios are indicative of aggressive long-side positioning and a pronounced upward directional bias in market sentiment toward the underlying equities. The surge in Call option demand has consequently propelled implied volatility (IV) higher, leading to an expansion in option premiums and increasing the cost of carry for initiating fresh directional long positions. However, this sharp tilt towards Calls may warrant a contrarian perspective due to potential rally fatigue, possibly signaling near-term overbought conditions. Conversely, Multi Commodity Exchange of India (MCX) and ICICI General Insurance Company (ICICIGI) are experiencing an uptick in Put option volumes, with Put-to-Call Volume Ratios (PCRs) remaining in a relatively balanced range. This intensified Put activity suggests a cautious market stance, reflecting elevated risk aversion and a clear preference for downside protection. A notable build-up in Put Open Interest (OI) typically aligns with either bearish market sentiment or portfolio hedging strategies. Nevertheless, concentrated Put exposure may also imply that these counters are approaching critical technical support zones, which could present contrarian buying opportunities for value-oriented investors. Kaynes Technology and Infosys (Infy) have registered increased activity on the Call side, a phenomenon generally interpreted as a bullish signal and reflective of positive price expectations. However, this specific trend demands closer scrutiny, as the rise in Call volumes could be equally attributed to Call writing strategies, including short-covering or hedging operations, rather than solely representing outright speculative long interest. Finally, Persistent Systems (Persistent Ltd) and Nestle India continue to display a sustained accumulation in Put Open Interest, reinforcing a defensive market posture. While explicit directional conviction remains subdued, the persistent build-up of protective Puts highlights prevailing concerns regarding near-term volatility and downside risk exposure. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the net change of 29,767 contracts was primarily driven by a substantial bearish tilt from Clients, who decisively reduced their long exposure by 21,304 contracts, contrasting sharply with the aggressive accumulation of 26,177 contracts by Foreign Institutional Investors (FIIs), signalling a strong bullish bias; simultaneously, Proprietary traders exhibited a moderate reduction of 8,463 contracts, suggesting profit-taking or a neutral-to-cautious stance. Similarly, in stock futures, the total change of 36,937 contracts was marked by the significant unwinding of positions by Clients (a noteworthy reduction of 22,510 contracts), which was partially offset by the measured addition of 10,919 contracts by FIIs, indicating a selective positive outlook, while Proprietary traders displayed a pronounced bearish liquidation of 14,427 contracts, reinforcing a cautious approach in the single-stock segment.

Nifty

Bank Nifty

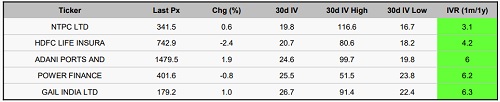

Stocks with High IVR:

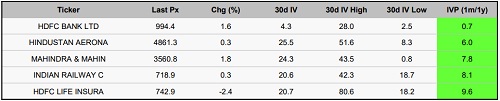

Stocks with Low IVR:

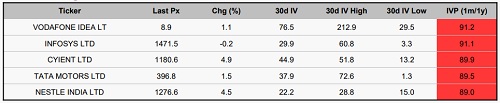

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Market Wrap Up 12th Aug 2025 by Shrikant Chouhan, Head Equity Research, Kotak Secur...